General descriptions #

Reconciliations in mass balance enable you to add or subtract quantities from a feedstock within a single location. Reconciliations are typically included to avoid discrepancies between the recorded quantity and the actual available quantities of feedstock.

The overview of all the reconciliations added can be checked on the mass balance overview screen.

You need special permissions in Qbil-Trade Mass balance module to be able to add, edit or delete reconciliations.

Adding a new reconciliation #

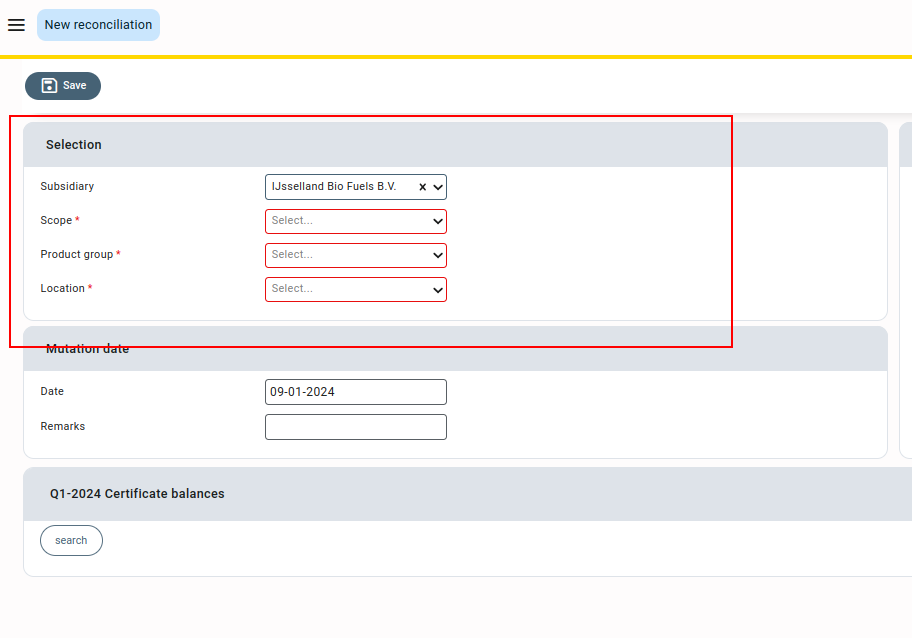

- Select the Subsidiary.

- Select the Scope & Product group of the feedstock for which you want to reconcile feedstock.

- Select the location where you want to reconcile feedstocks.

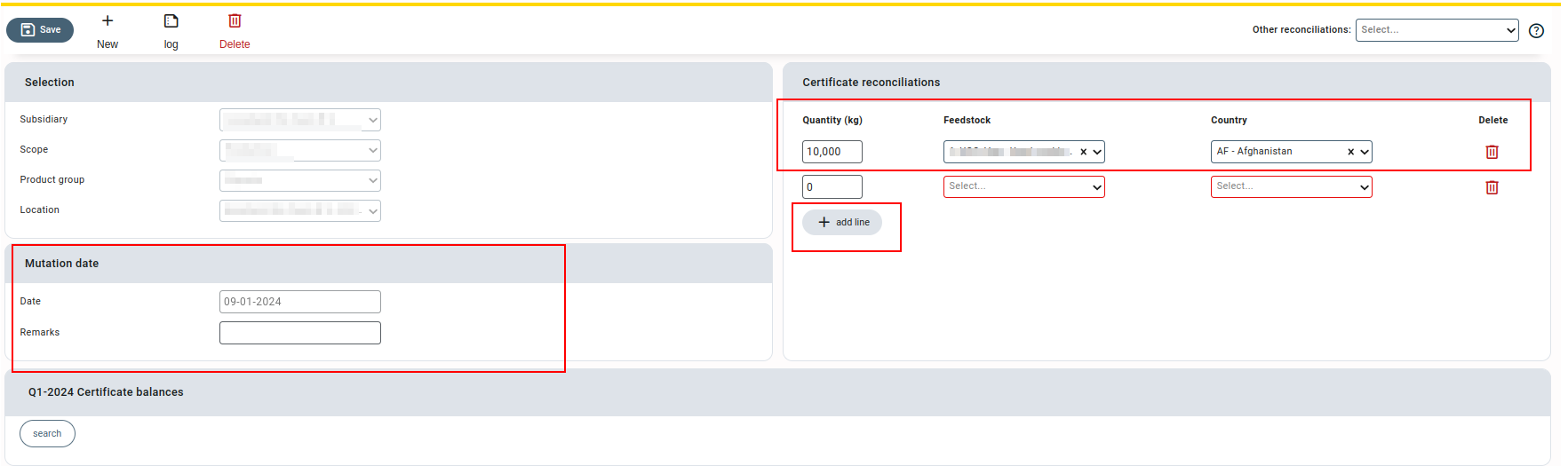

- Press or click on “Add line”.

- Enter the mutation Date and remarks(if any).

By default, the current date is auto-filled in the Date. - Enter the reconciliation details Quantity, Feedstock, and Country.

You can add more than one reconciliation line.

- Press or Click on “Save” and the reconciliations will be saved.

You can both add and deduct quantities using the reconciliation screen. You can add a negative sign “-” to deduct the quantity.

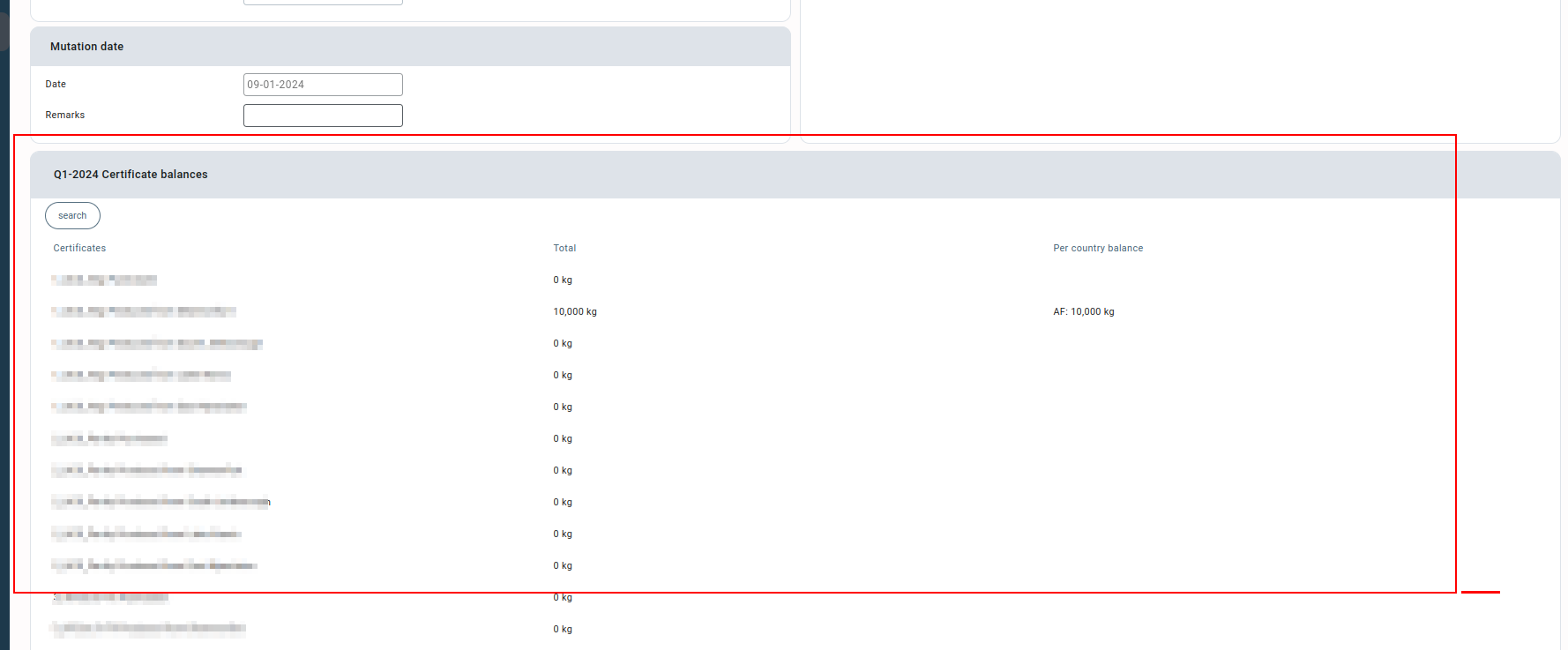

Certificates balances #

You can also check the balances of the certificates as per the selection made in the reconciliation screen using the “search” button.

Editing reconciliations #

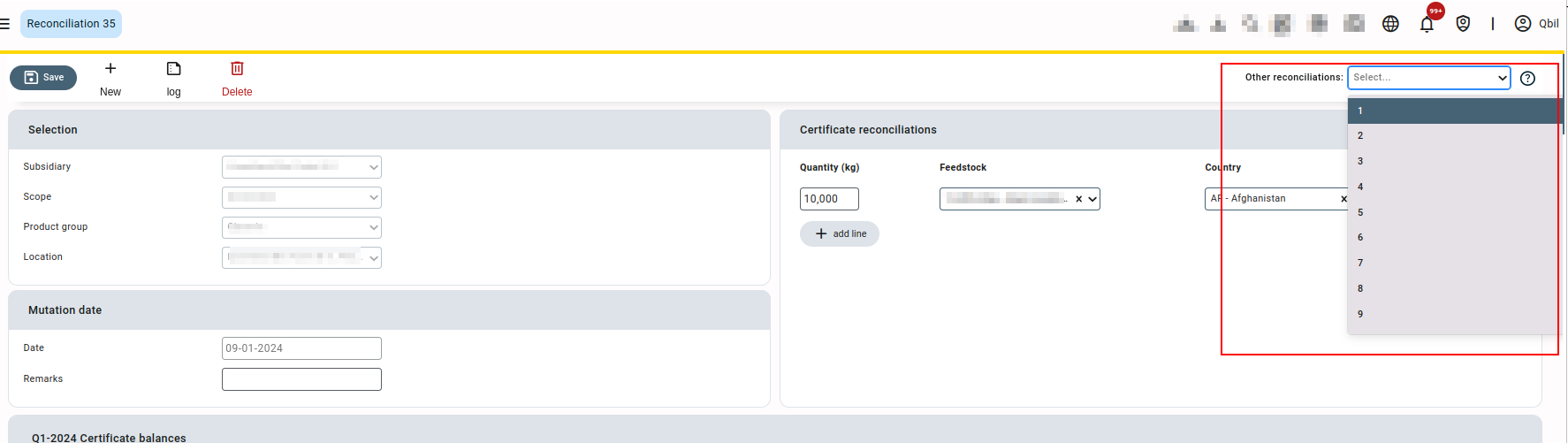

You can edit & re-save the already added reconciliations, by selecting the record in the drop-down “other reconciliations”.