General description #

Country risk in Qbil-Trade is covered in a basic way. Country risk is usually involved when trading in a foreign country. In Qbil-Trade, the country risk can be accessed by your company if you are investing or trading in countries involving any country risk. The feature allows you to determine the effect of these risks on your business and plan and track the steps needed to manage or at least minimize these losses.

You can add multiple country risk groups and the percentage of country risk involved with each group using Country risk.

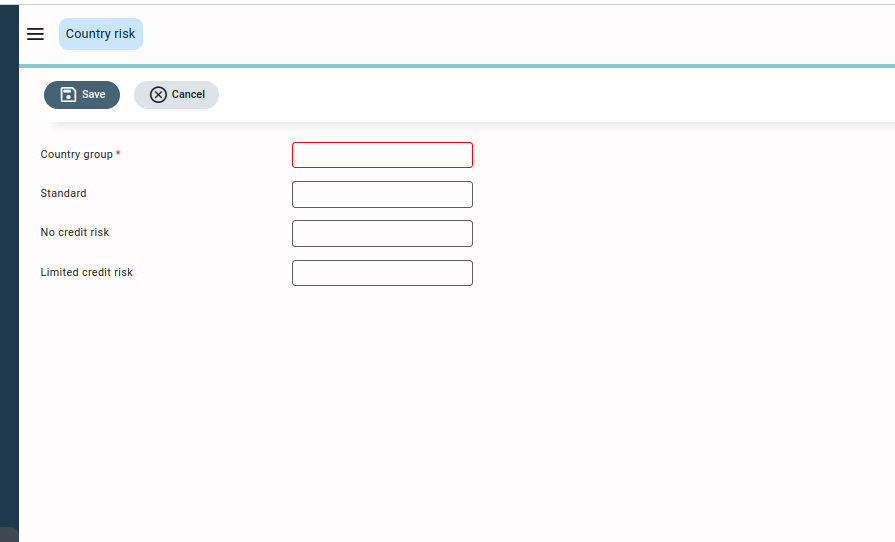

Adding a new country risk group #

- Press or click on “Create credit risk groups”.

- Enter the mandatory field Country group marked by red colour.

- Add other details like standard, no credit risk and limited credit risk.

These details are usually contracted between the company and the credit insurance company and are filled in accordingly. These values (percentages) may change annually and can be updated accordingly.

Screens where country risk is used #

Some examples where the country risk can be used in Qbil-Trade are:

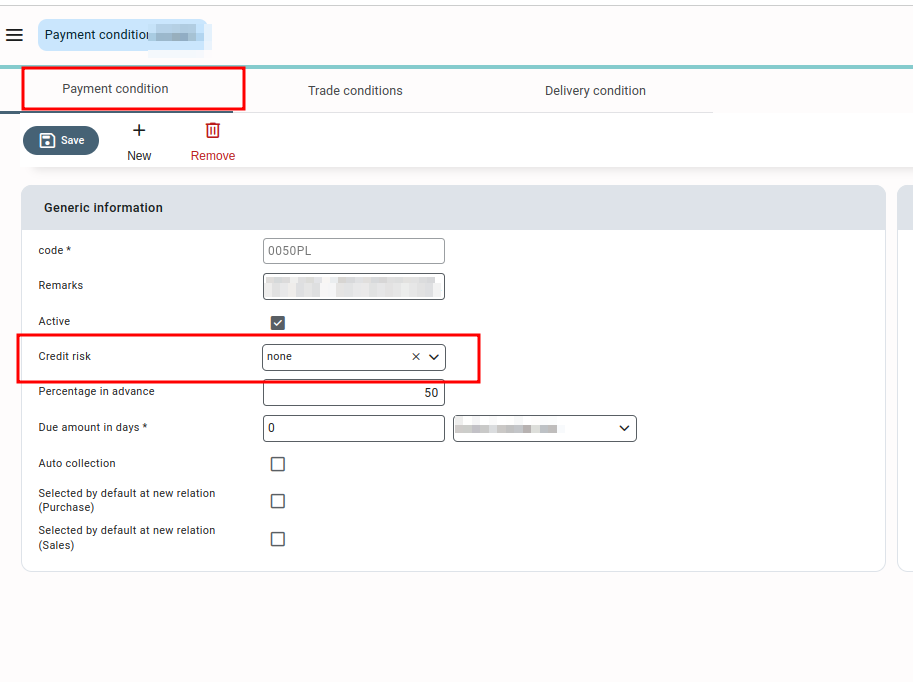

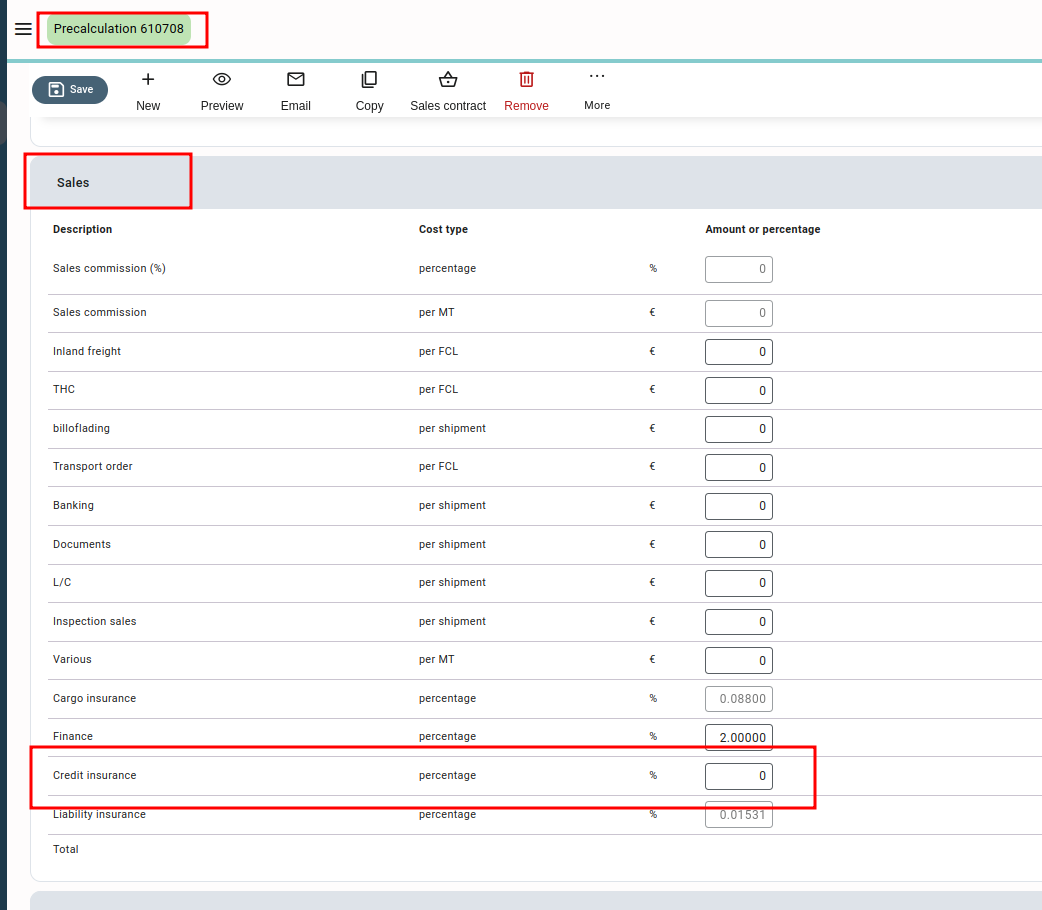

- Pre-calculation screen, if the selected country is listed under any country risk group and if the selected payment condition involves any credit risk.