General description #

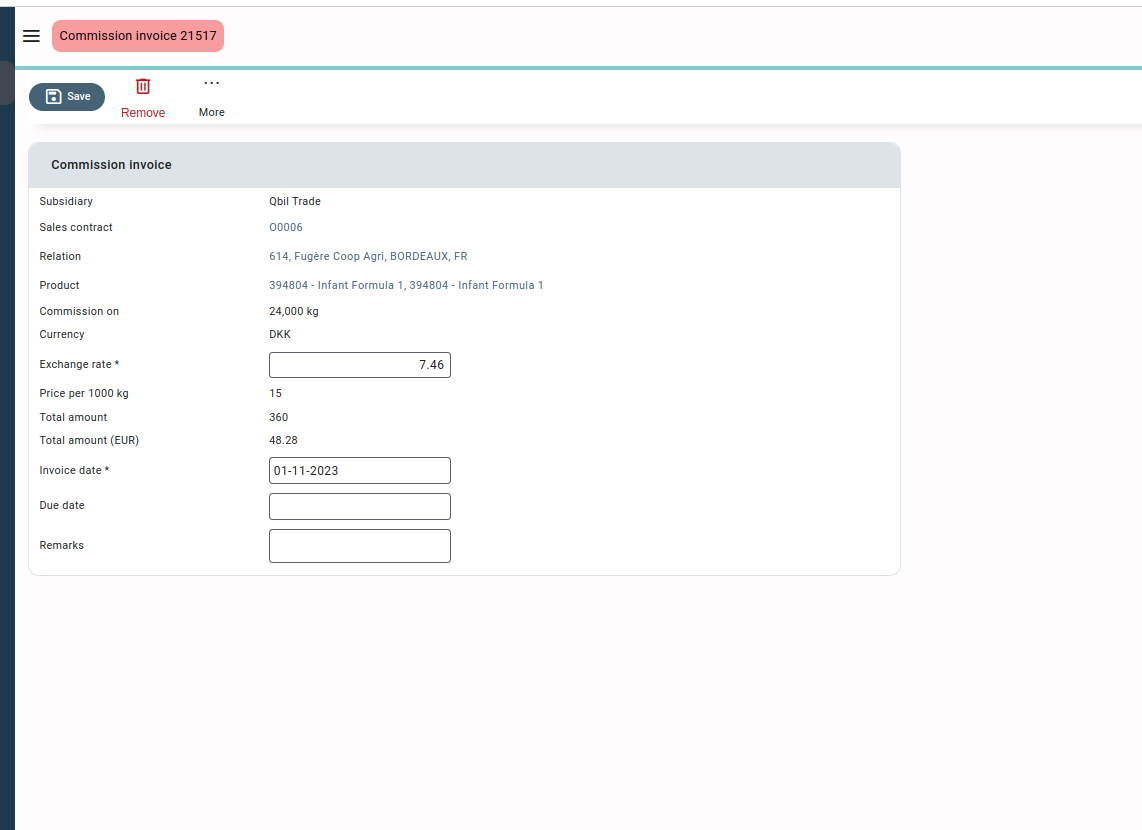

The commission invoices are the expected invoices created for the agent or brokers associated with the broker agreement of a contract. The commission amount can be paid either as a percentage of the total amount of the contract or order quantity, based on the commission basis or it can also be paid per 1000 units to the broker, as per the broker agreement.

The commission invoice gives general information, payment details, and invoicing details related to the associated broker agreement, contracts, and orders (if any). You can book an expected commission invoice on the purchase invoice screen.

The commission invoices for the broker in Qbil-Trade are generated in two ways as per your business requirements: contract quantity and delivered quantity.

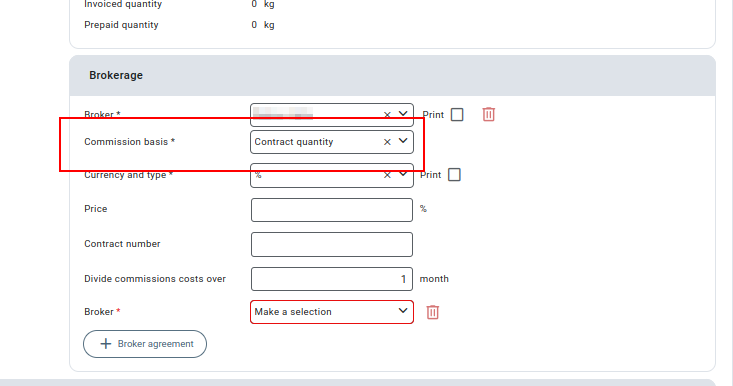

Contract Quantity #

You can select the contract quantity in the broker agreement of the contract if you’re required to pay a commission on the total contract quantity. When the contract quantity is selected as a commission basis in a broker agreement, in such cases commission invoices are created shortly after saving the contract.

For the broker agreement created for contract quantity, you also have the option to enter the number of months over which you wish to distribute the commission payments, that is, you can pay the commission in instalments. Using this the commission invoices are generated monthly as per the value entered and with different due dates.

For example, let’s assume the contract quantity is 10,000 units, the commission rate is USD 10,000 per 1000 units, and you choose to pay the commission in 5 monthly instalments. In this scenario, the system will generate five commission invoices, each for $20,000 ($1,00,000 divided by 5) to be paid monthly over the specified instalment period.

Dividing the commission into instalments allows for a more manageable payment schedule rather than paying the entire commission amount at a time.

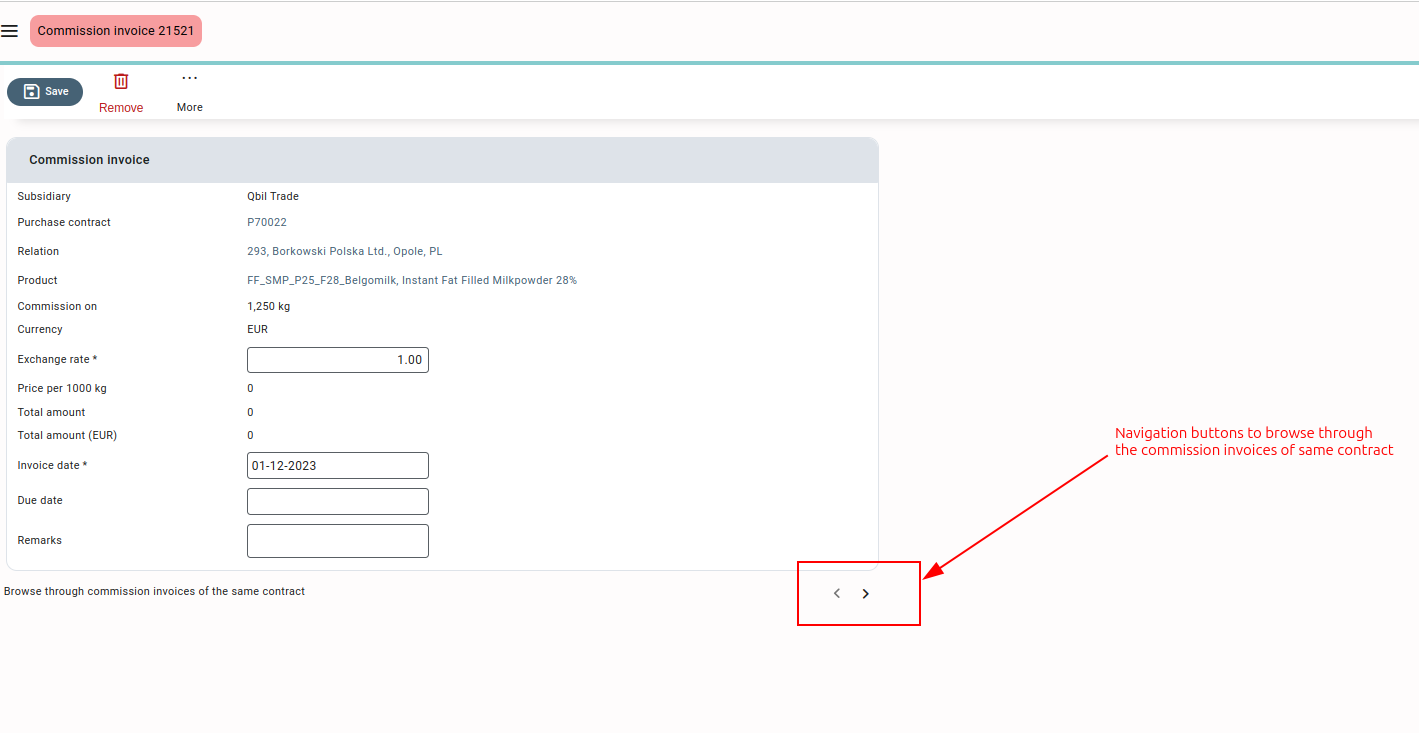

You can browse between the commission invoices created for a contract using the separate navigation buttons.

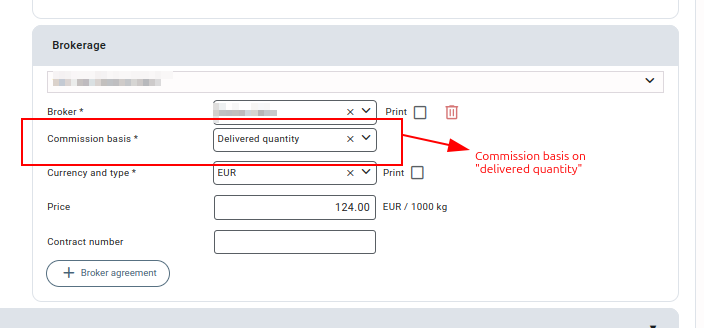

Delivered Quantity #

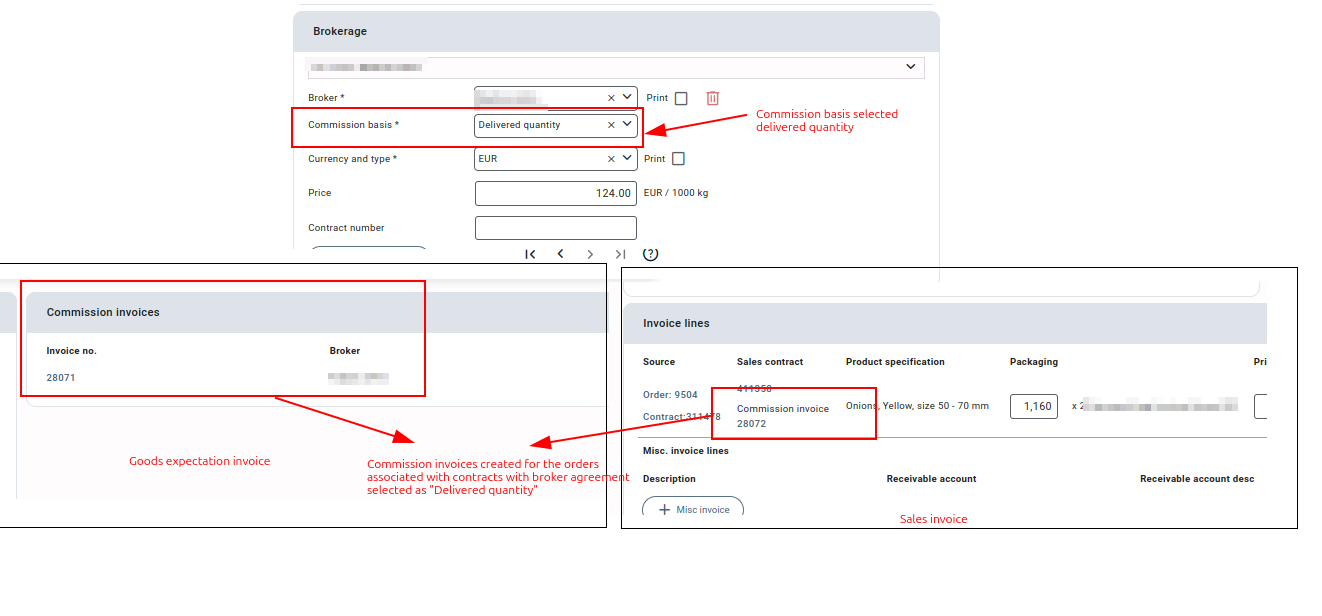

The commission in the broker agreement can also be based on the delivered quantity, that is the commission will only be calculated for the quantity from the contract for which the order has been created. Commission invoices in such cases are created after the contract has been used in the order and sales or purchase invoices are created.

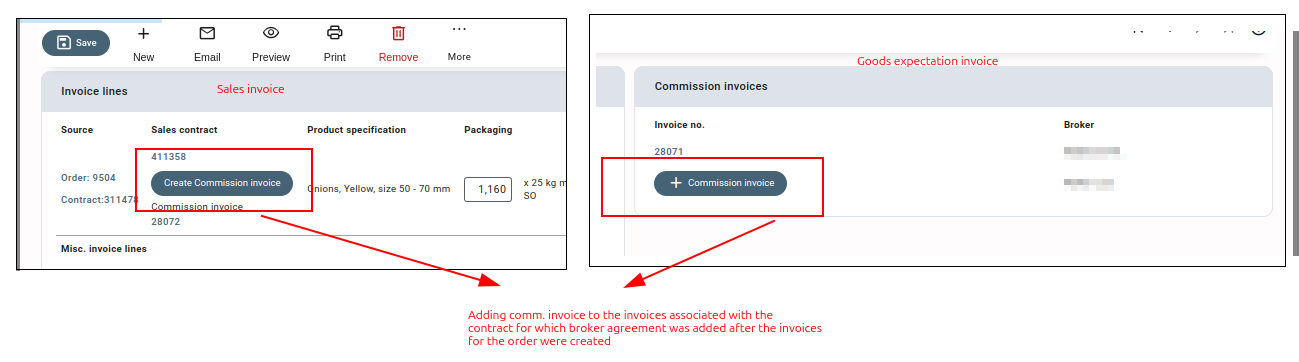

If the broker agreement is added to a contract after invoices are generated for the order, you can manually add the commission invoices to such invoices.

The commission is calculated for an invoice either in percentage or amount in any currency (which can be selected in the broker agreement of contract). The choice between calculating the commission in any currency or as a percentage is usually made based on the specific agreement between the broker and the client.

- If the commission is calculated in any currency like USD, the invoice will reflect the specific amount of commission based on the invoice quantity and the agreed-upon rate. For example, if the invoiced quantity is 100 units and the commission rate is USD 10000 per 1000 units, the invoice will show a commission amount of USD 1,000.

- On the other hand, if the commission is calculated as a percentage, the invoice will display the commission as a percentage of the total invoiced amount. For instance, if the invoiced value is $10,000 and the commission rate is 5%, the invoice will show a commission amount of $500.

Please note when the percentage is selected for commission calculation, the currency of the contract is used in the commission invoices.