Payment Conditions #

Payment conditions in Qbil-Trade allow you to manage payment terms with your relations for purchases and sales orders. These conditions specify the period allowed for a buyer or seller to pay off the amount due and may demand cash in advance, cash on delivery, a deferred payment period of 30 days or more, or other similar provisions.

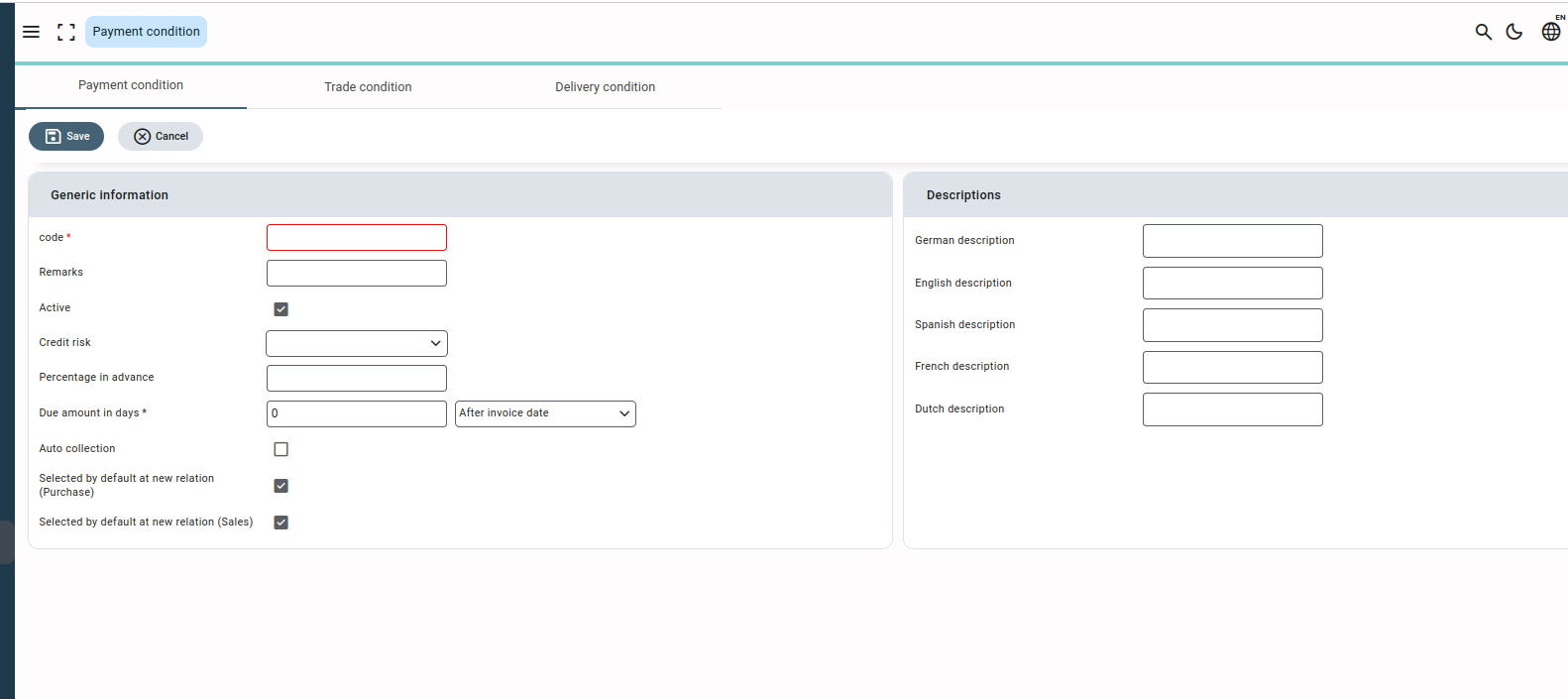

Adding a new payment condition #

- Click or press on “New”.

- Enter the fields with relevant data. Make sure to fill in the mandatory fields marked in red color to save a payment condition.

- Click or press “Save” to save the new payment condition to Qbil-Trade.

Please note that “descriptions” in each language are ultimately being printed on documents generated in and from Qbil-Trade.

Where payment conditions are used #

Some examples where Payment conditions can be used in Qbil-Trade:

- Purchase contract, sales contract

- Precalculation.

- Sales invoice, Proforma Invoice, and Misc Sales Invoice.

Detailed explanations for certain fields #

- Active Checkbox: while reusing the same payment condition, you will be aware that the payment condition is still active or not.

- Credit risk: The field can be used to determine whether any credit risk is associated with the payment condition or not.

- Auto collection checkbox: With this field’s help, money will be withdrawn or deposited from or to the bank account mentioned on the subsidiary screen.

- Selected by default at new relation (purchase/sales): If marked, this payment condition will be set as default for every new relation.

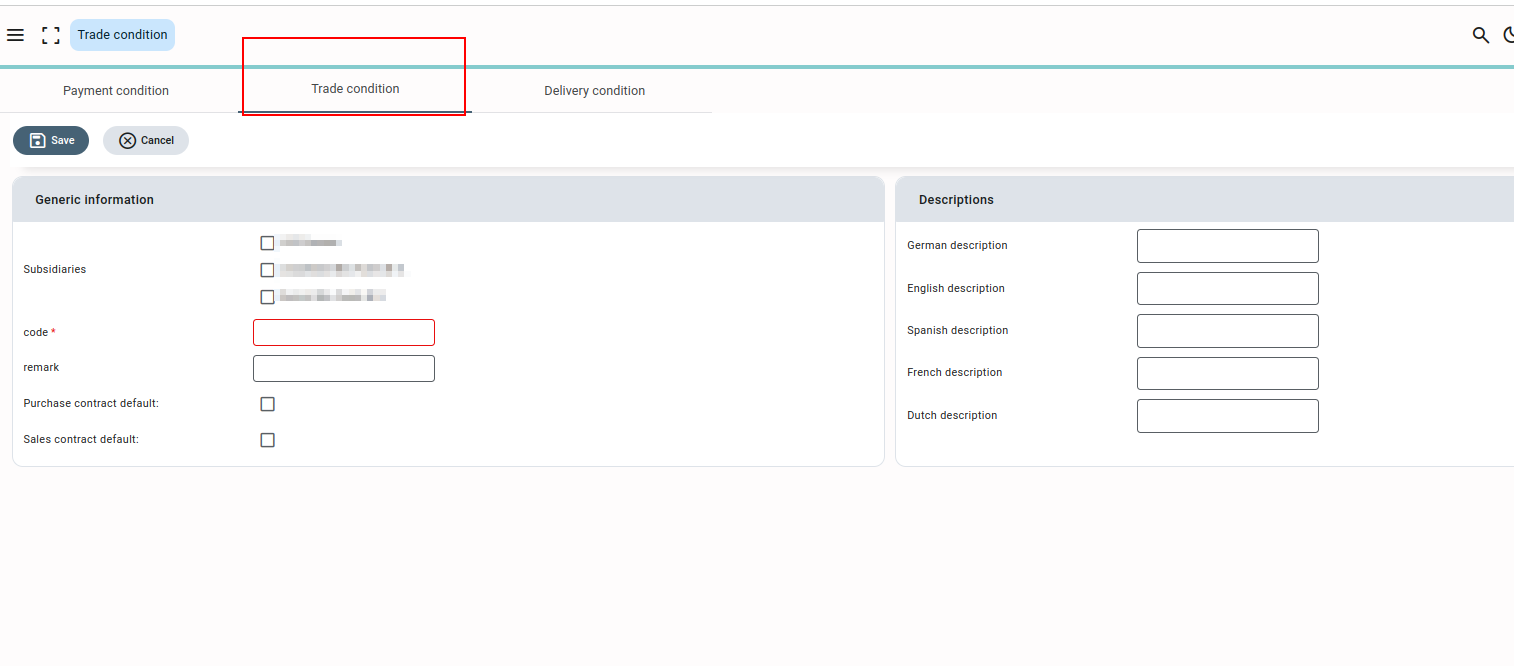

Trade Condition #

The trade conditions are the trade terms selected for contracts and agreed upon by both parties. The terms of transportation, storage, or other handling of goods are governed by these standard trading conditions between the parties. A trade term cannot be removed when used on a booking or mutation.

Adding a new trade condition #

- Click or press the “New” option.

- Enter the relevant fields and at least fill in the mandatory fields marked in red color to save a new trade condition.

- Click or press “Save” to add the new trade conditions to Qbil-Trade.

Please note that “descriptions” in each language is ultimately being printed on documents generated in and from Qbil-Trade.

Where trade conditions are used #

Some examples of where trade conditions can be used in Qbil-Trade:

- Purchase contract, Sales contract.

- Sales Invoice, Proforma Invoice, and Misc sales Invoice.

Detailed explanation of certain fields #

- Purchase contract Default Checkbox: Trade conditions will be used by default while creating any new purchase contract.

- Sales contract Default Checkbox: Trade conditions will be used by default while creating any new sales contract.

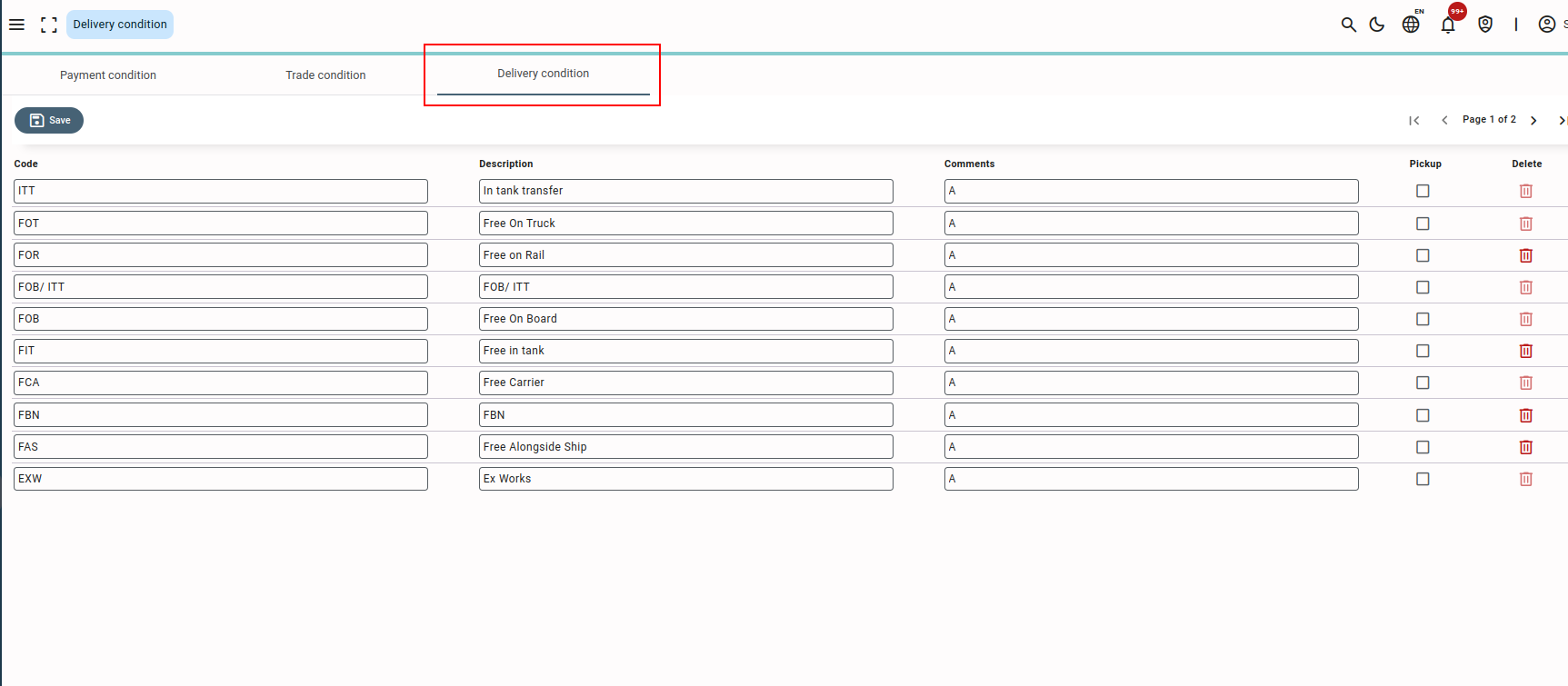

Delivery condition #

A delivery condition is an agreement ensuring the contractual conditions which include the transporter, routing, transport charges, place of delivery, and time of delivery. You can use these conditions upon making an order/mutation in Qbil-Trade. These conditions are used to inform the parties what to do with respect to carriage of the goods from buyer to seller, export & import clearance.

Adding a new delivery condition #

- Press or click “Add”.

- Enter the description and comments. Make sure to enter at least data in the mandatory field code marked by red colour.

- Press or click “Save” and a new delivery condition is added to Qbil-Trade.

Please note that “descriptions” in each language is what ultimately is being printed on documents that are being generated in and from Qbil-Trade.

Some of the commonly used delivery conditions: #

- Free carrier (FCA): This term means that the seller delivers the goods, cleared for export, to the carrier nominated by the buyer at the named place. The seller pays for carriage to the named place.

- Delivered At Place(DAP): Seller pays for carriage to the named place, except for costs related to import clearance, and assumes all risks prior to the point that the goods are ready for unloading by the buyer.

- Delivered at Terminal(DAT): Seller pays for carriage to the terminal, except for costs related to import clearance, and assumes all risks up to the point that the goods are unloaded at the terminal.