General description #

The VAT component allows you to add the VAT rates. In addition to the VAT rate code, the VAT percentage must be specified. A VAT rate cannot be removed when used on a booking/mutation.

VAT codes are mainly meant for the correct routing into the accounting software. Different codes can have different purposes:

- The first difference is in percentage. Based on the type of product, a different percentage is applicable. For instance, most of our customers trade in feed and food. Most of these goods get a 9% vat rate. But when you add transport to your sales invoice, the transport needs to have a 21% rate. Then there is also a 0% rate which hardly any of our customers will use. And there is an option for VAT to be exempt. This rate may be applied when the goods are being delivered to a certain country (other than your own). For instance, if I deliver the goods to the customer outside of my warehouse in the Netherlands (and he ships the goods to Germany), I need to invoice/apply 9%, but when I deliver the goods to his warehouse in Germany, the VAT is exempt. The customer will then need to tell the German authorities that he imported goods from the Netherlands and must pay the 9% in Germany instead of paying the 9% to me. I am obligated to print a certain text on my invoices to notify my customer that he needs to inform German authorities. On this tab, you can enter this text in the “Deviation text” section. Here we use Germany as an example, but there are many situations possible where different VAT regulations may apply. It important is to know the location of the goods and the country of the supplier and customer. There are too many scenarios and exceptions to discuss in this document.

- Based on the code you select, you can enter the different ledger accounts on this tab for revenue and costs when you create a sales invoice and select a certain VAT code. Upon exporting the sales invoice to the accounting software, the export will add the correct ledger account to the journal entry for the accounting software. So the revenue is being presented on the right ledger account. In Qbil-Trade, you can enter the ledger accounts for revenue and costs of goods per product group. Some of our customers also want to create a difference in their accounting software, i.e. geographical areas or different types of customers. So you could have multiple VAT codes for the same type of trade. For instance, when I sell Milkpowder within Europe, I want to have the revenue on the ledger account 80100, but when I sell Milkpowder to the US, I want to have the revenue on the ledger account 80200 and so on. I will need to create a code within Europe and for the US, etc.

- The third difference is based on the actual tax report created by the accounting software. The VAT codes of Qbil-Trade and the accounting software need to correspond with each other before sending journal ledgers from Qbil-Trade to the accounting software. Within the accounting software, each VAT code is routed to different fields on the tax report. Mainly this is percentage and country-driven. So basically, the first point but more from the idea that the end report should be filled out correctly without having to do manual steps.

So when creating the VAT codes, these things must be kept in mind. In most cases, the customer already has their own setup in the accounting software and will copy that into Qbil-Trade.

Adding a new VAT #

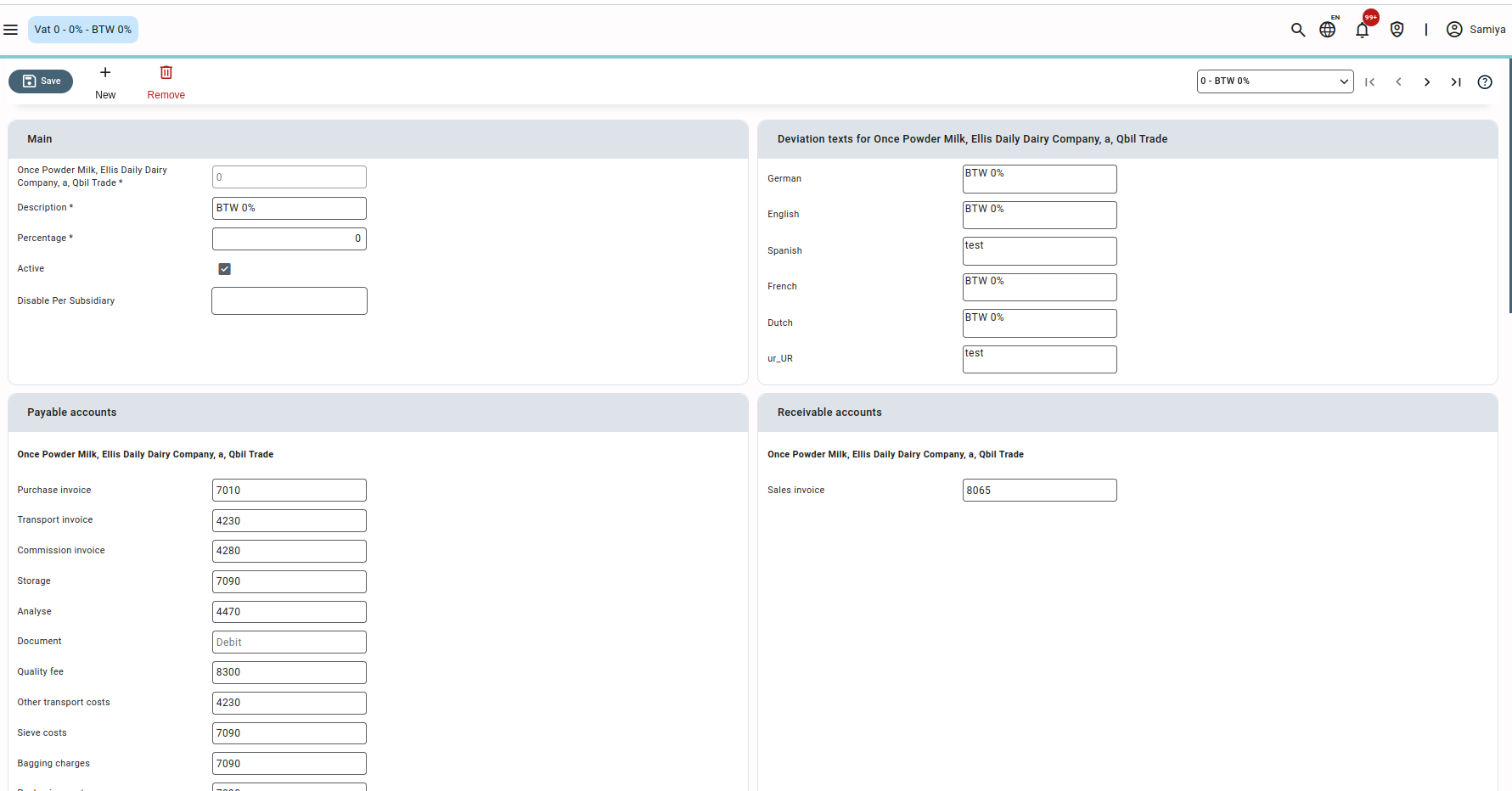

- Click on the “New” button.

- Enter the relevant field with data. Make sure to at least enter data in the mandatory fields marked by the red colour.

- Entered VAT percentage will be imposed on the Net amount.

- Ledger accounts :

- Payable accounts: The payable account section includes the costs with their associated account numbers. Every VAT number has its account number for every cost.

- Receivable accounts: The Receivable account section includes the sales invoice account numbers.

- Press or click “Save”, and a new VAT is added.

Please note that “descriptions” in each language is ultimately being printed on documents generated in and from Qbil-Trade.

Where VAT is used #

- Sales invoice.

- Misc sales Invoice.

- Proforma Invoice.

- Purchase Invoice.

Detailed explanation of certain fields #

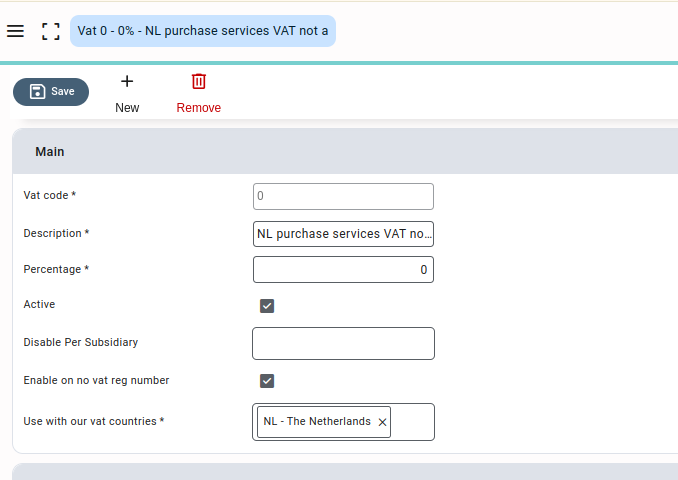

- Active: The checkbox is used to indicate whether the VAT is in use or not. If unchecked the VAT will not be available for selection on various invoices,

- Intracommunity: The check box, when checked helps in determining the exporting of invoices along with the other mandatory check (“Our VAT number = NL and Their VAT registration number =!NL”), if the VAT is used in the invoices.

- Disable per subsidiary: The field helps to disable a VAT for one subsidiary while keeping it enabled for other subsidiaries. You can disable a VAT for more than one subsidiary.

- Enable on no VAT reg number: There are some countries, such as the USA, China, etc., that don’t have a VAT number. For those countries, we have a checkbox that allows you to select this VAT code irrespective of VAT rules.

- Use with our vat countries: Countries are selected here with which the VAT will be associated.