General Description #

A credit limit is usually the amount that a credit insurance company has assured to pay as coverage for the relation. But it can also be considered the maximum amount that you agree to trade on credit with the relation. The credit limit for a relation is specified in the subsidiary-specific fields section of the Finance tab of Relation root data. Depending on your business requirements, you can either allow a common credit limit to relation for all of your subsidiaries or allot a separate credit limit to relation for each of your subsidiaries.

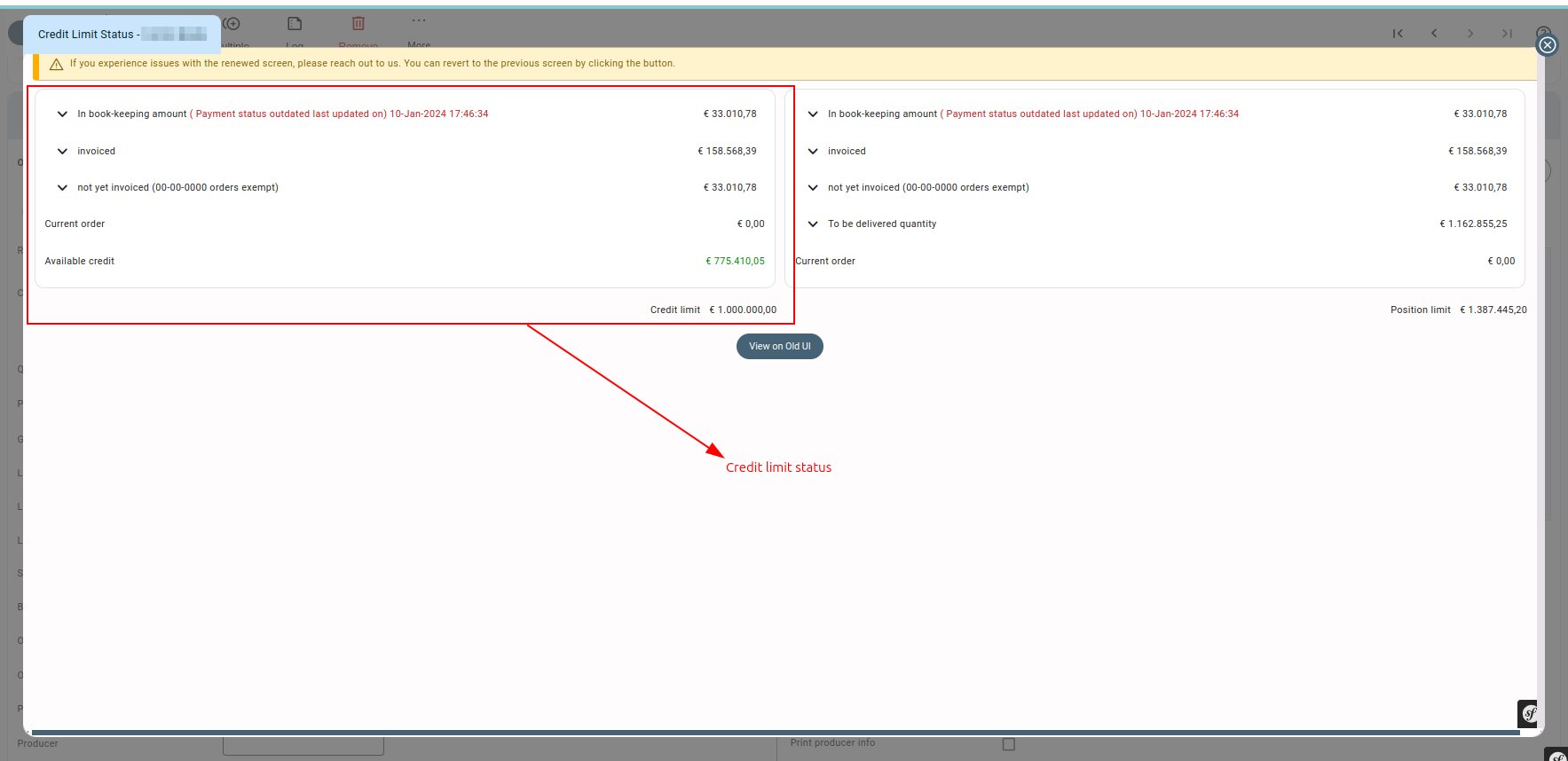

You can check the credit status of a relation using the “€” sign on the current position field of the Finance tab of the relation screen. A pop-up appears when you click the Euro (€) sign. The sign is available on the contract and order screen when a relation is selected. The credit limit pop-up gives the credit status of the relation as per the orders and invoices made for the relation in various columns. The various values available on the credit limit pop-up are:

- In bookkeeping: This line gives the total value of the invoices that are exported but have not been paid yet or do not have a payment date. You can click on the “+” sign to get an expanded or listed view of all the invoices that are in bookkeeping.

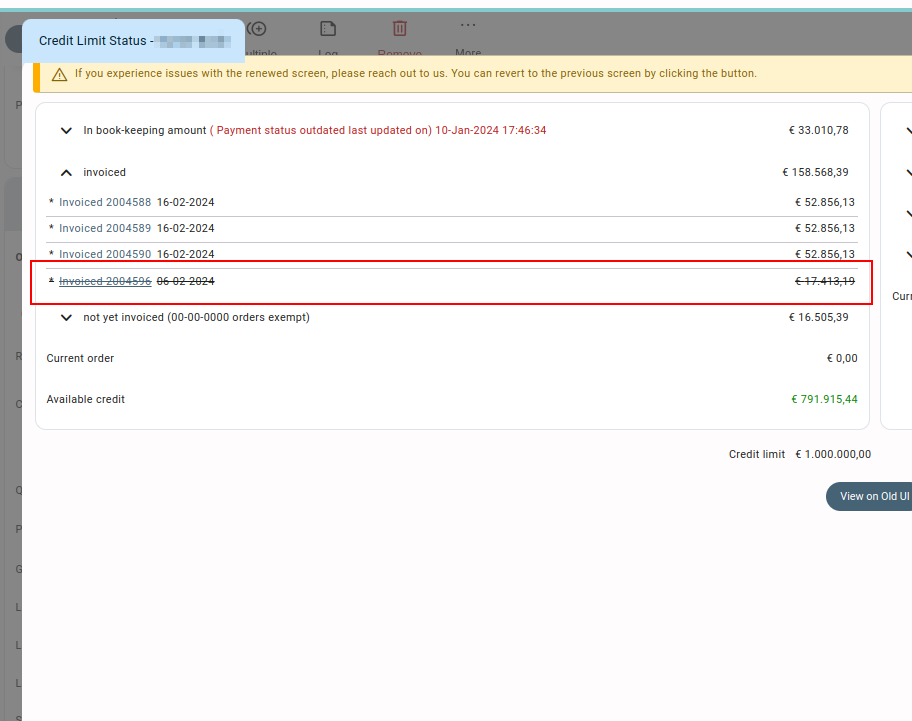

- Invoiced: This line gives the total value of the invoices that are neither exported nor paid. You can click on the “+” sign to get an expanded/listed view of the invoices that are not exported or paid.

- Non-invoiced: This line gives the total amount from the orders for which invoices have not been created yet. You can click on the “+” sign to get an expanded/listed view of the orders that have not been invoiced yet.

- Available credit: This line gives the remaining credit limit available for the relation currently. Usually, this is calculated by subtracting the bookkeeping, invoiced, and non-invoiced amounts from the allotted credit limit for the relation. If the relation has not been allotted any credit limit, this will display the sum of in-bookkeeping, invoiced, and non-invoiced amounts (in red and with a negative sign).

If the credit limit of a relation has expired, the message “The validity of the credit limit has expired. It was valid until DD-MM-YYYY (validity date)” is shown in red in this line. - Available additional limit: This line gives the sum of available credit and additional credit limit (if set) for the relation.

- Credit limit: The total credit limit, including the additional limit set for the relation is displayed in this line. If no credit limit has been set for the relation, it will display “0.”

While calculating the credit limit status of a relation, the invoices or contracts in which the payment condition used has a credit risk of “none” are excluded. These invoices or orders are displayed but striked out in the credit limit pop-up.

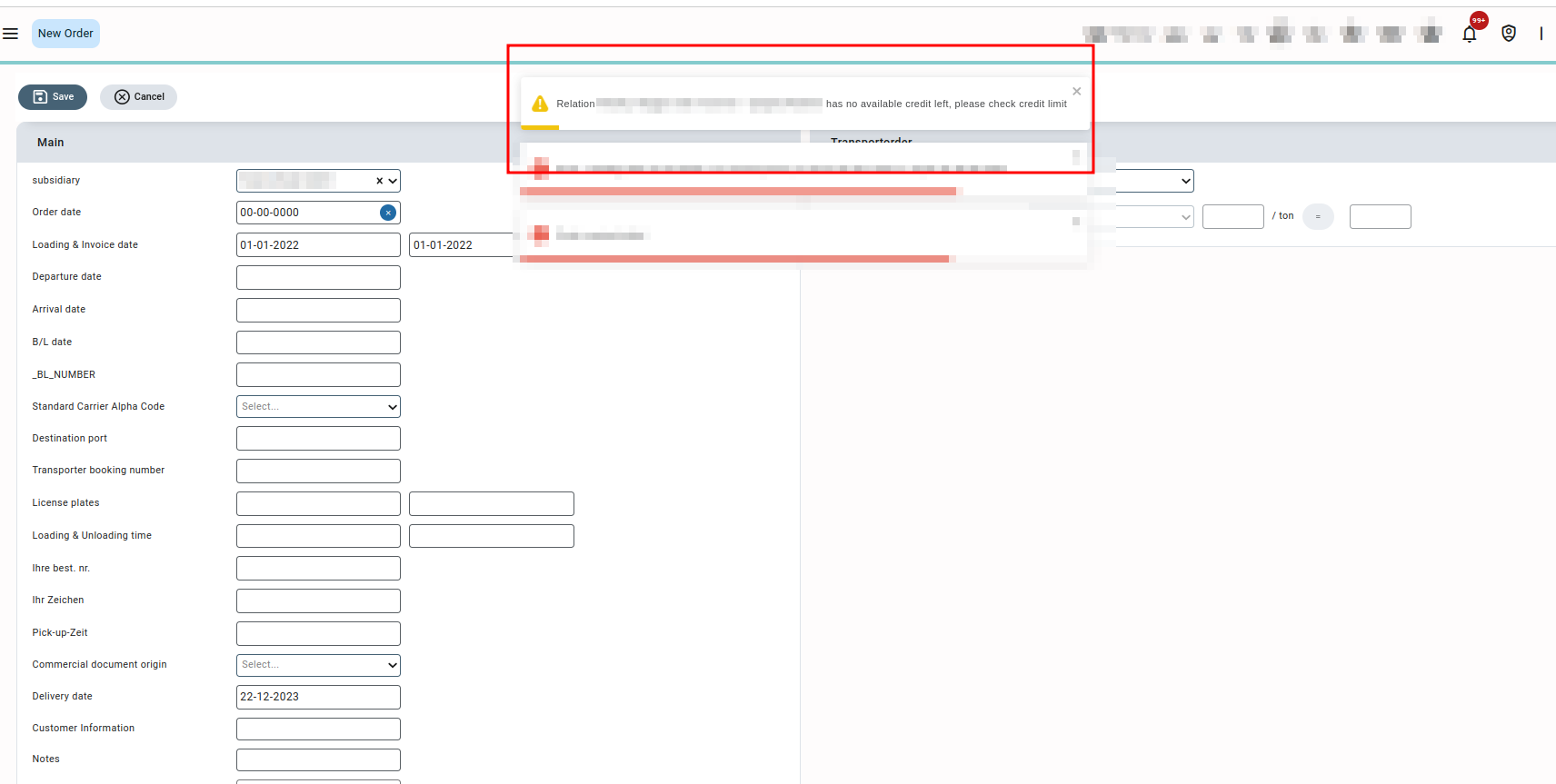

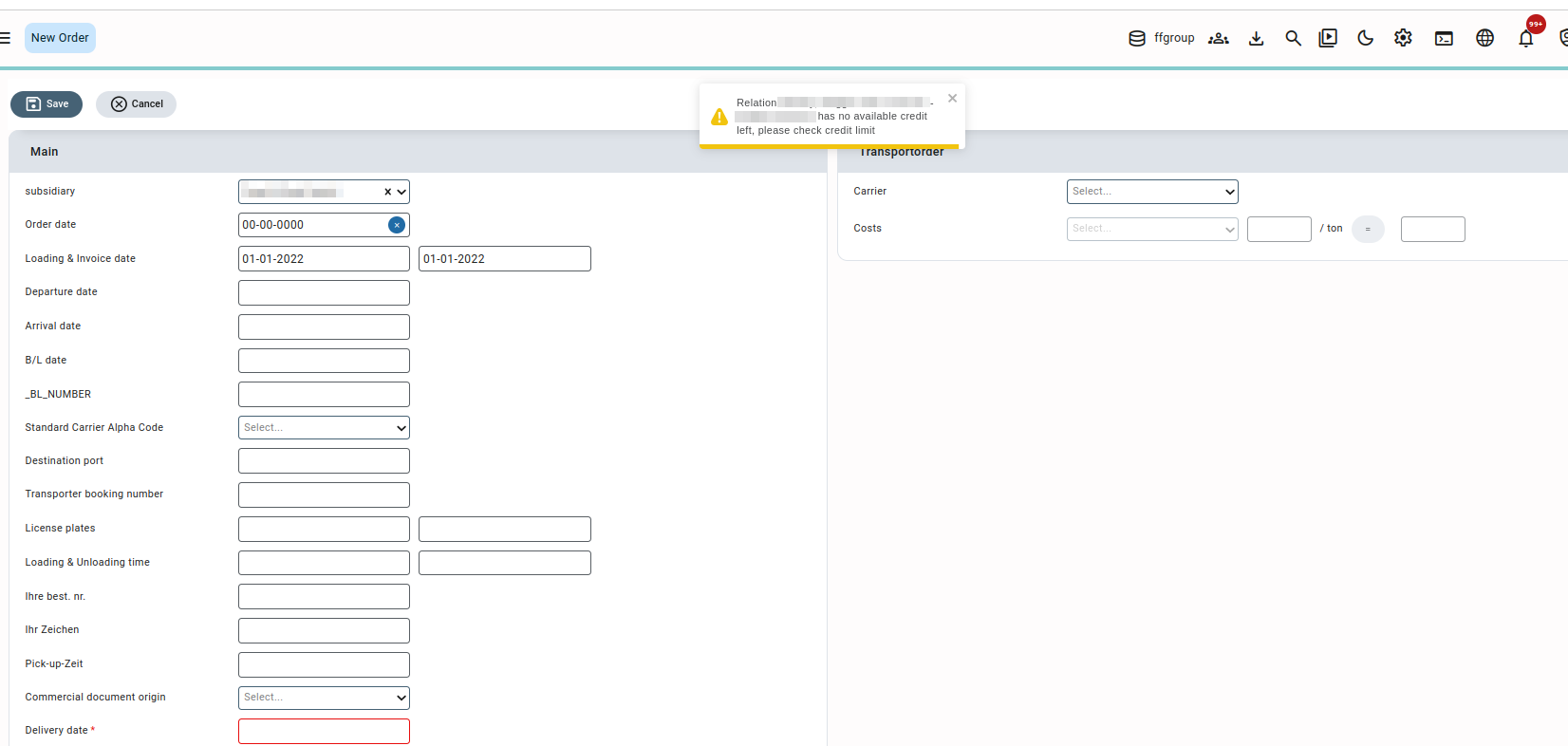

Qbil-Trade will notify you if and when the credit limit has been exceeded for a relation and throw a warning/alert on the order screen. But you won’t be restricted from creating orders or invoices for the relations even after displaying the credit limit exceeded warning.

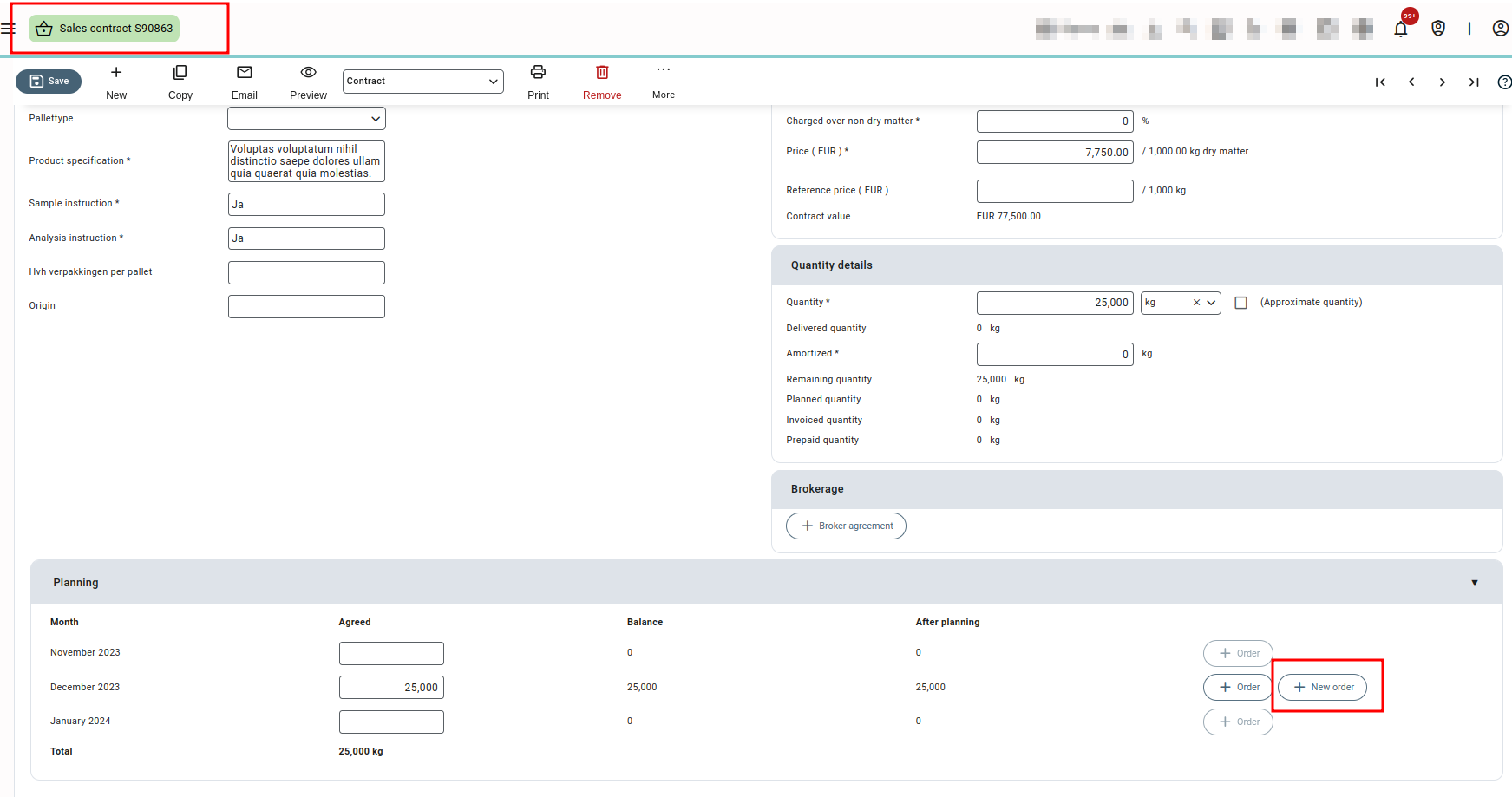

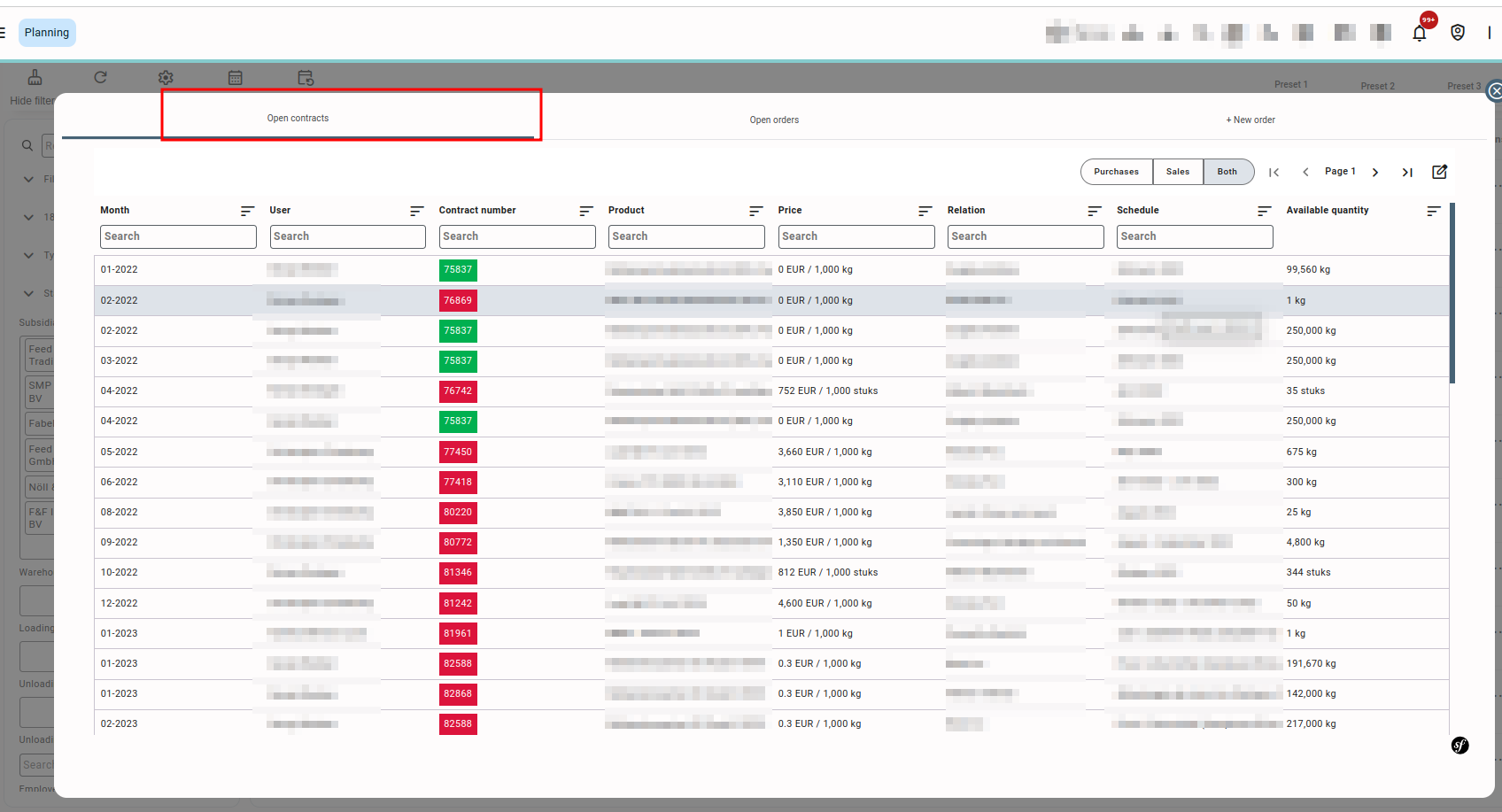

This warning is also displayed when creating a new order for the relation from the sales contract’s planning section using the “New Order” button and from the new planning screen using the “open contracts” section.

Credit limit currency difference #

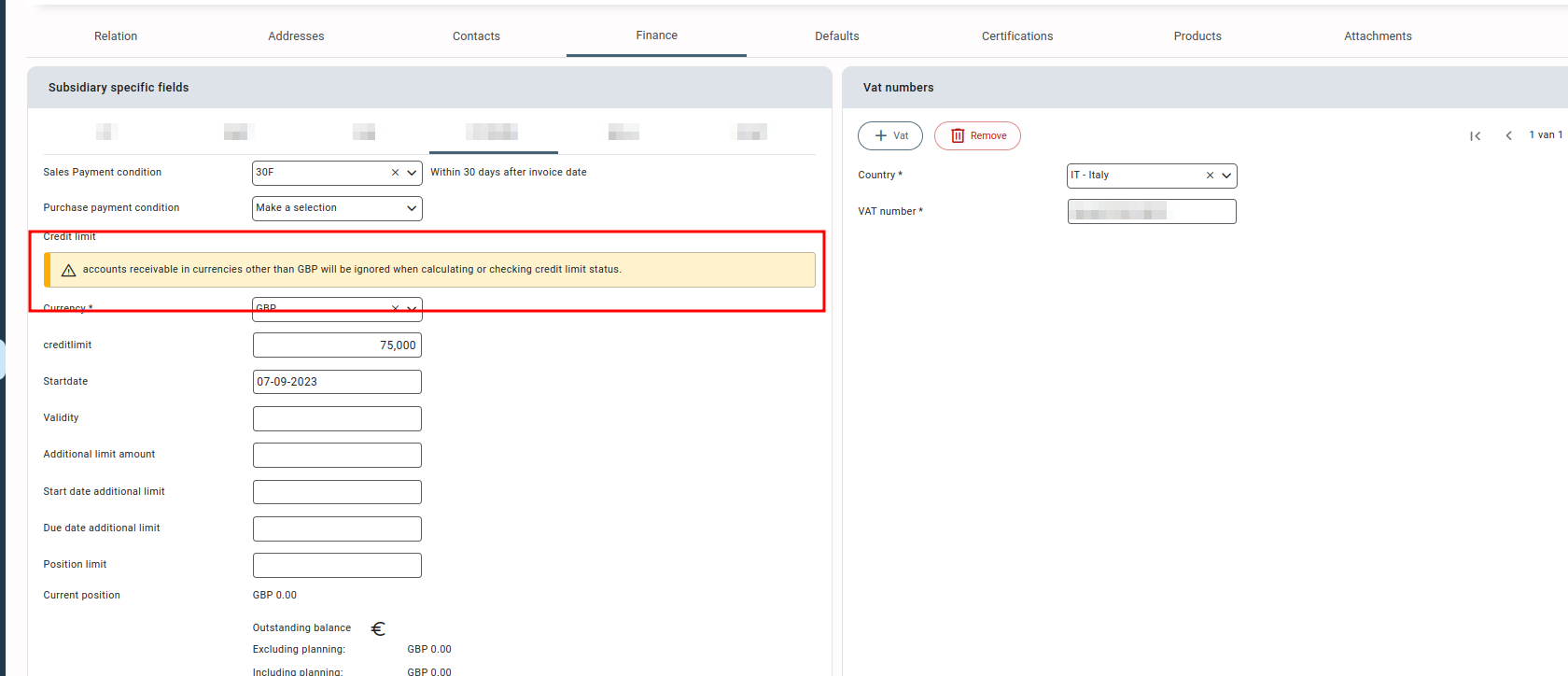

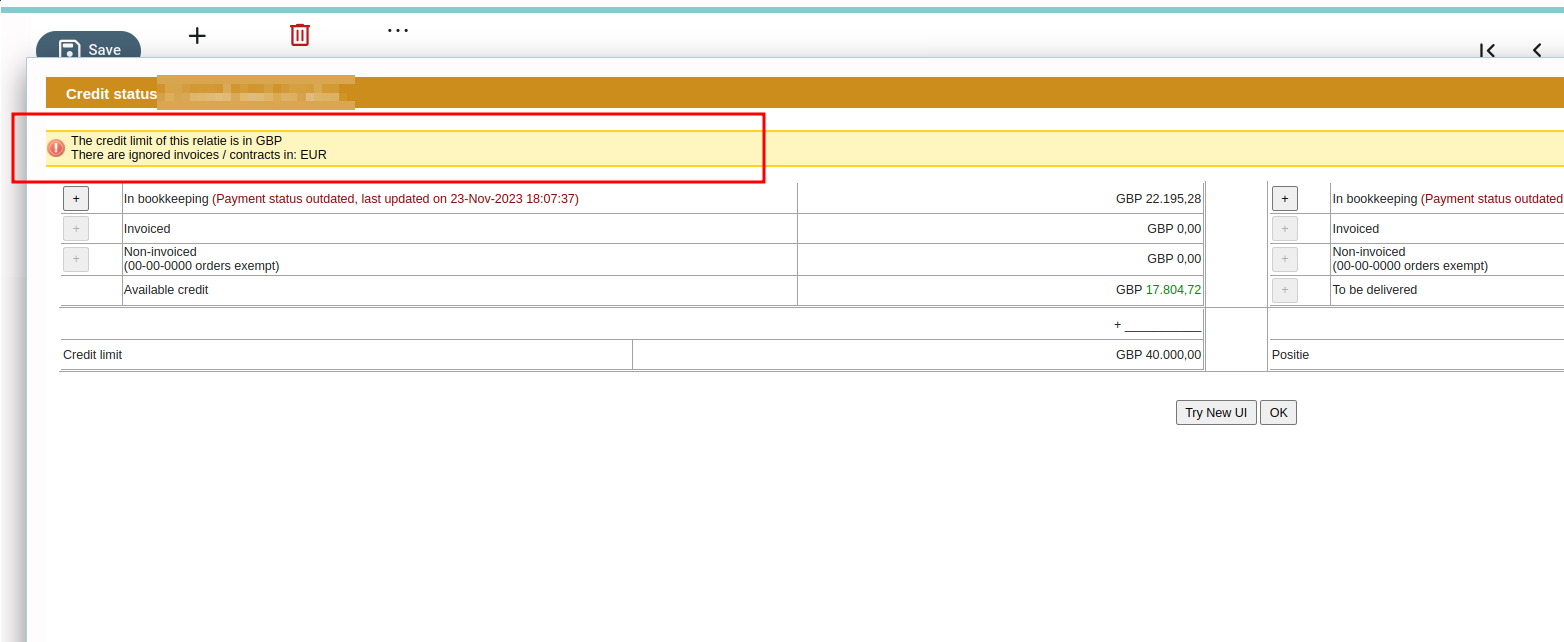

The credit limit pop-up displays the credit limit status of a relation in the currency selected for the credit limit in the Relations screen. If the base currency and credit limit currency for a relation are the same, and the currency used in invoices/contracts made for the relation is different, the credit limit status for the relation will be checked normally. For example, if a subsidiary’s base currency is EUR and the credit limit currency set for a relation is also EUR, whether the currency used in the relation’s contracts/invoices is EUR, USD, GBP, or another, the credit limit status will be calculated and displayed in EUR.

However, if the base currency and credit limit currency for the relation are not the same, the currency used in invoices/contracts made for the relation must be the same as the credit limit currency. Otherwise, the invoices/contracts of relations with currencies other than the credit limit currency will be ignored for the credit limit check. For example, suppose a subsidiary’s base currency is EUR and the credit limit currency for a relation is USD. A warning will be displayed initially while selecting the credit limit currency in the accounts and financial tab of relation screen “Attention: accounts receivable in currencies other than USD will be ignored when calculating or checking credit limit status.”

This means that if the currency used in contracts or invoices made for the relation is EUR, GDP, or any other currency than USD, the credit limit check for such contracts, orders, or invoices won’t be calculated, and the credit limit pop-up will display the message “The credit limit of this relation is in USD. There are ignored invoices/contracts in EUR.”

Exporting Credit limit #

While exporting relation data from Qbil-Trade to your accounting software, the credit limit details are also exported. Sometimes the credit limit is exported as “0.” The scenarios in which the credit limit of a relation is exported as “0” are:

- If the user has fully used the credit limit and additional credit limit (if allotted),

- If the credit limit has exceeded its validity or expiration date,

- And if the start date of the credit limit is before today’s date.

Miscellaneous information #

Some other extra information regarding the credit limit in Qbil-Trade:

- The credit limit for a relation is calculated as per orders and invoices made for the relation.

- The credit limit also depends on the credit risk as per the payment condition.