General description #

The accounting setup in rootdata allows you to add a new accounting setup that can be used for your subsidiaries’ accounting operations. In the accounting setup menu, you can create a new setup based on the accounting software you use and select the appropriate properties. This accounting setup is subsequently used in subsidiary root data to configure the subsidiary’s account and finance operations.

Please note the screen is enabled currently for Qbil-Trade users only.

Add a new Accounting setup #

You can add a new accounting setup by following the steps:

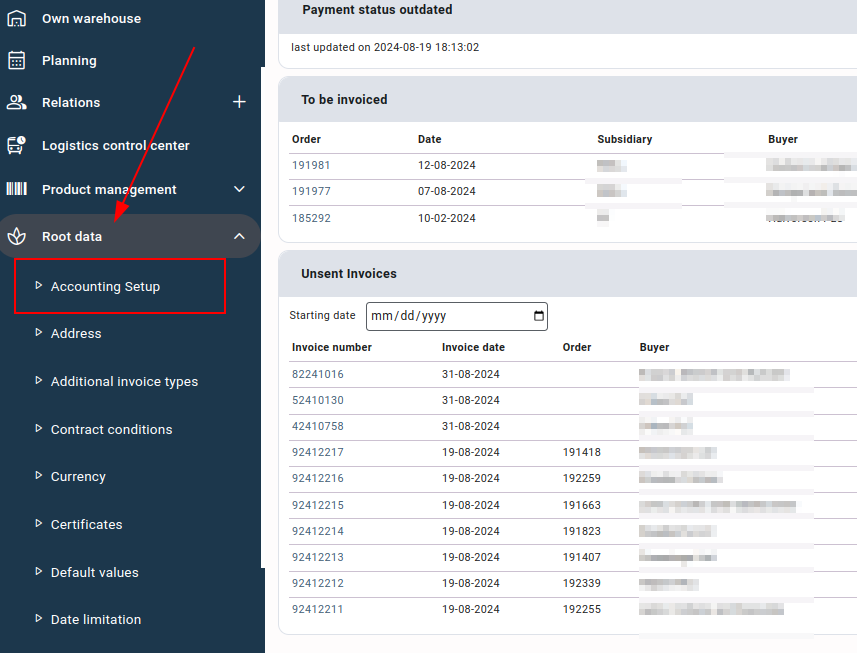

- Open “Accounting Setup” from the rootdata menu.

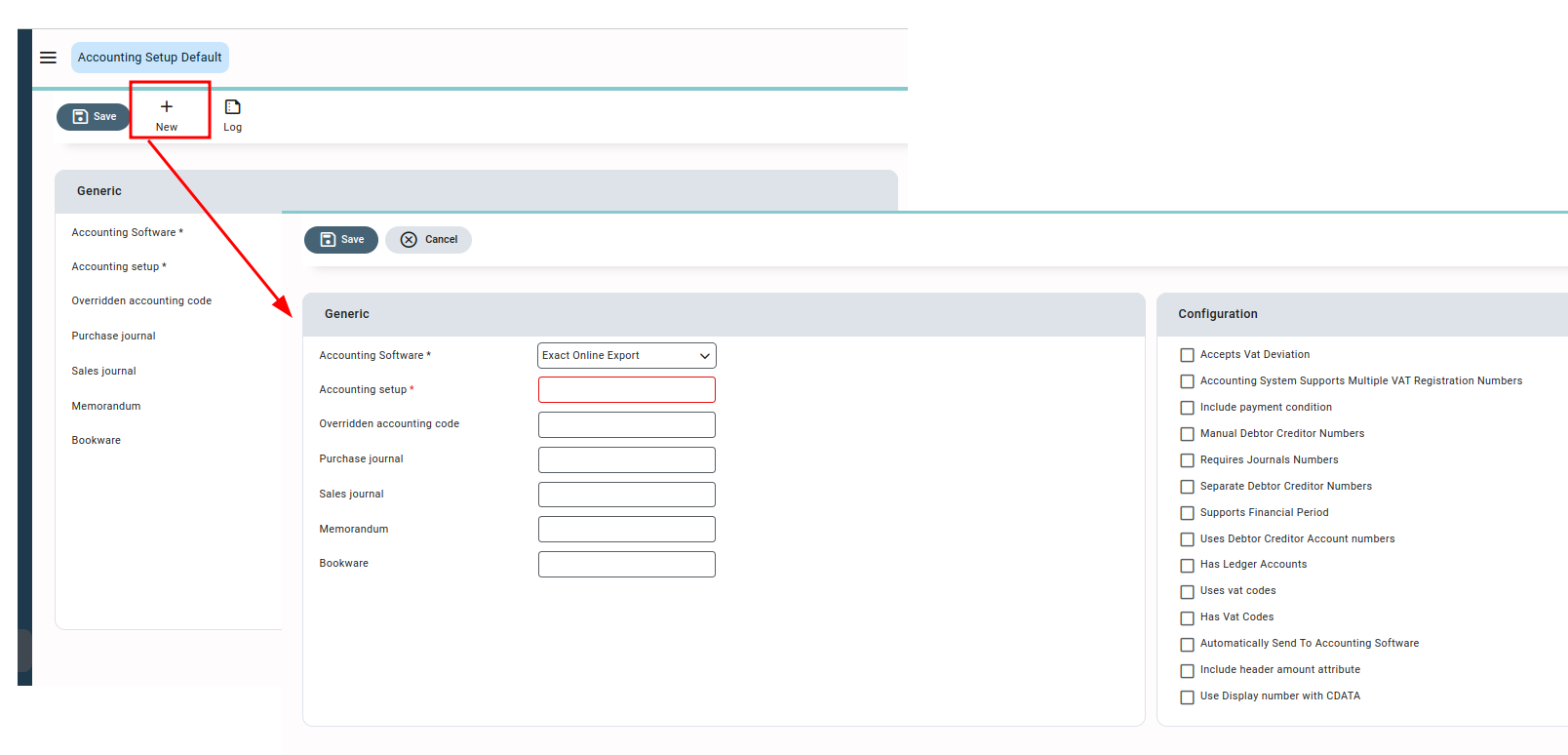

- Press or click on the “New” button and a new accounting setup screen will appear.

- In the new accounting setup, you are first required to select the accounting software that you (the subsidiary) are using for accounting purposes. Qbil-trade currently supports integration with the following accounting software:

- Exact Online Export,

- Exact globe Export,

- Account view Export,

- Cash Export,

- AS400.

- After selecting your accounting software, you can enter the name for your accounting setup in the field “Accounting setup,” for example, “default.” The name entered will help you to choose the accounting setup for a subsidiary in subsidiary rootdata.

- Fill in the other fields like purchase journal, sales journal, memorandum, etc.

- The purchase & sales journal numbers are the numbers allocated for the purchase invoices and sales invoices, respectively. These journal numbers are included in the export files and help the accounting software identify the type of invoice.

- Bookware: The details added in this column are reflected in the export files that are to be imported to the accounting software.

While these fields are not mandatory, we do recommend entering the information in the purchase and sales journal fields. Not having these journals entered in Qbil-Trade will result in your accounting software (such as Exact Online) being unable to determine the appropriate allocation for invoices and purchase entries, potentially leading to their rejection.

- Select the accounting setup configs or properties as per your accounting requirements.

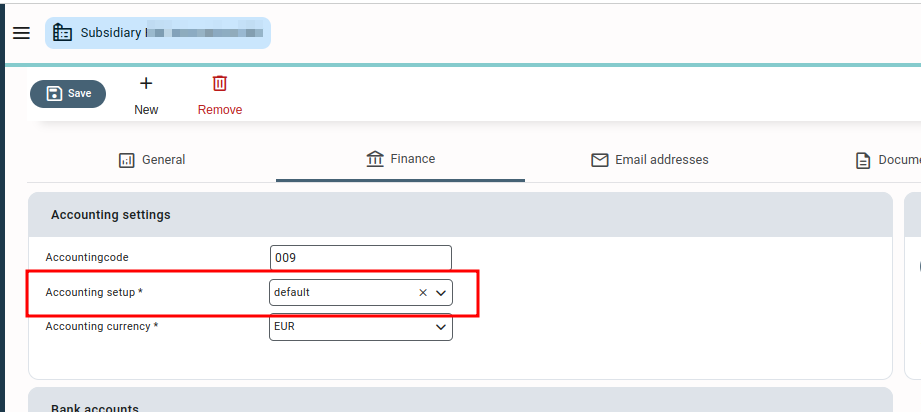

- After selecting the accounting properties for your setup, you can save the setup. The newly created accounting setup can be selected and used for the accounting purposes of your subsidiary or subsidiaries in the finance tab of subsidiary root data.

Accounting setup configs (properties) #

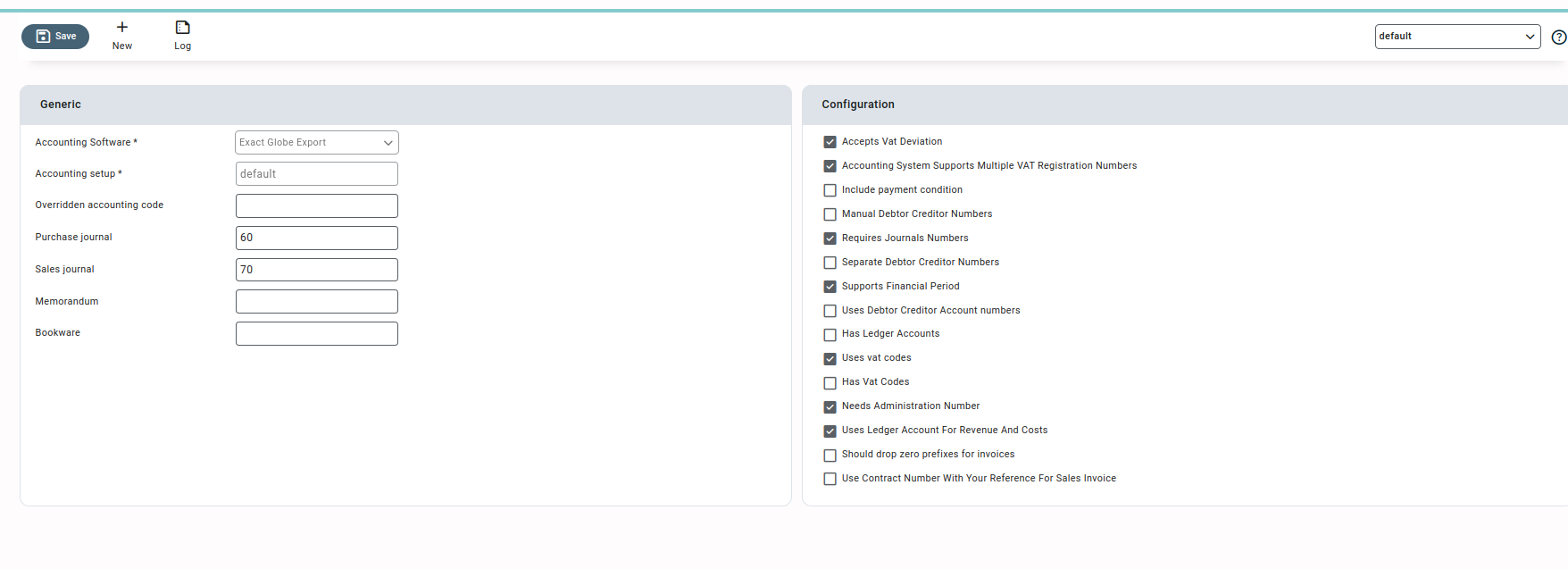

The accounting setup configs/properties are categorized as per the accounting software selected. These properties may likely change once you change the accounting software.

The details of the various accounting setup configs(properties) are as follows:

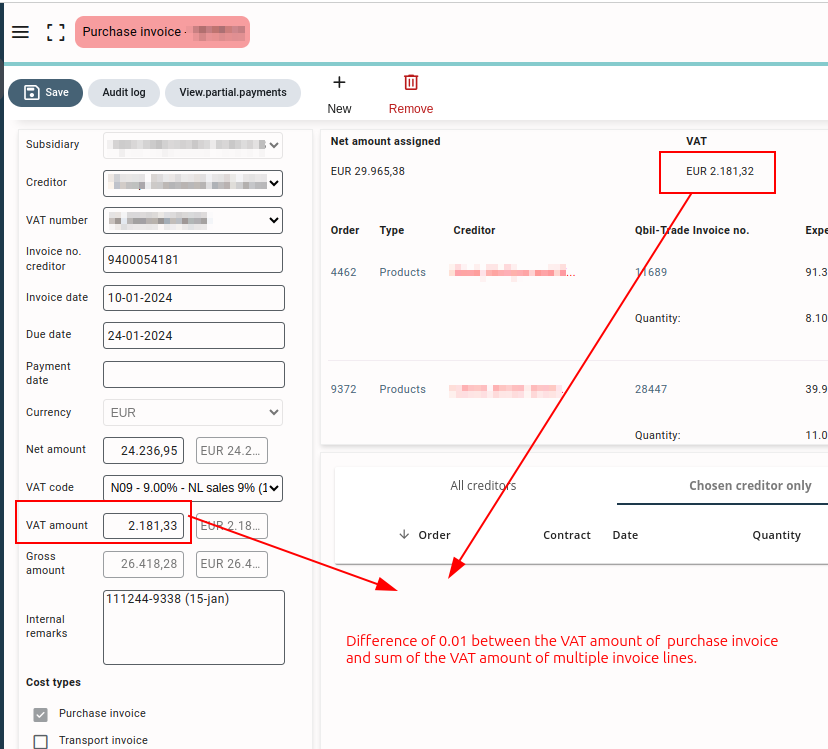

- Accepts VAT Deviation: Enabling this option allows you to book a purchase invoice even where there is a small difference (0.01) between the VAT amount of the purchase invoice and the sum of the VAT amounts of multiple invoice lines. This works only if the purchase invoice has more than one invoice line.

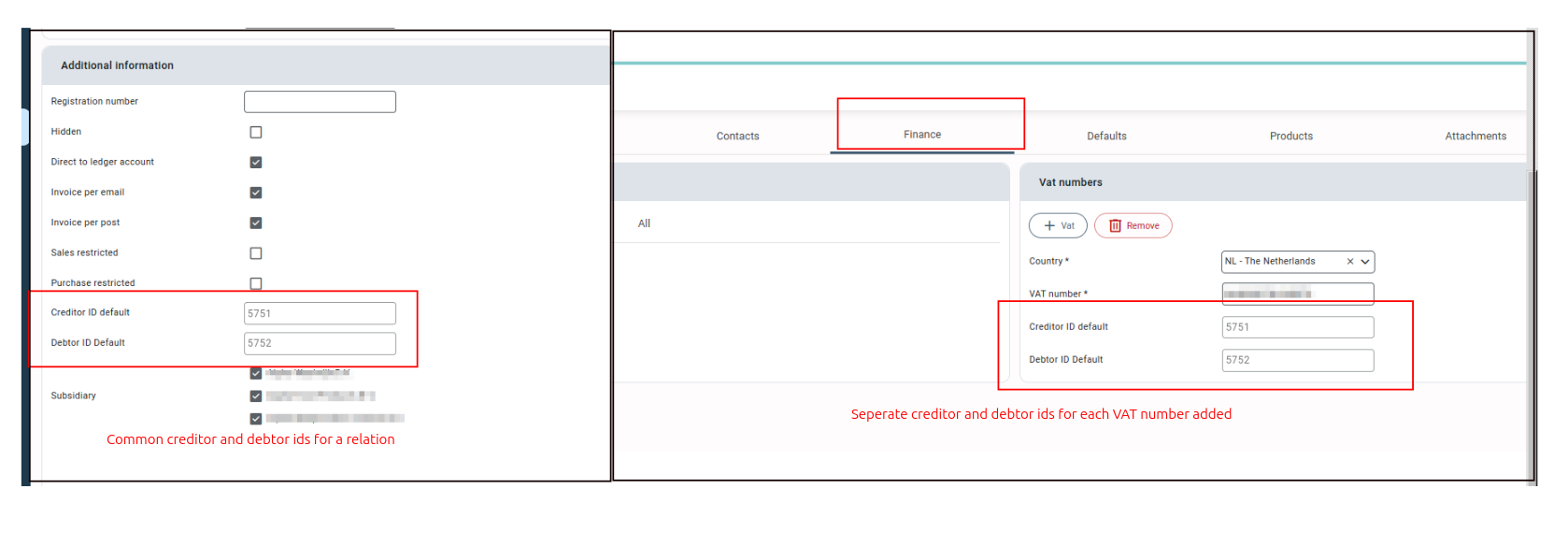

- Accounting System Supports Multiple VAT Registration Numbers: This option, when enabled, allows you to set a single creditor ID and debtor ID per relation, regardless of the number of VAT numbers added to the relation. If the option is disabled for an accounting setup, creditor IDs and debtor IDs are set as per the VAT numbers added to the relation.

- Include Payment Condition: Enabling this option allows you to include the payment condition (code) associated with the invoice in the export files. If disabled, the payment condition will not be displayed in the export file of the invoices.

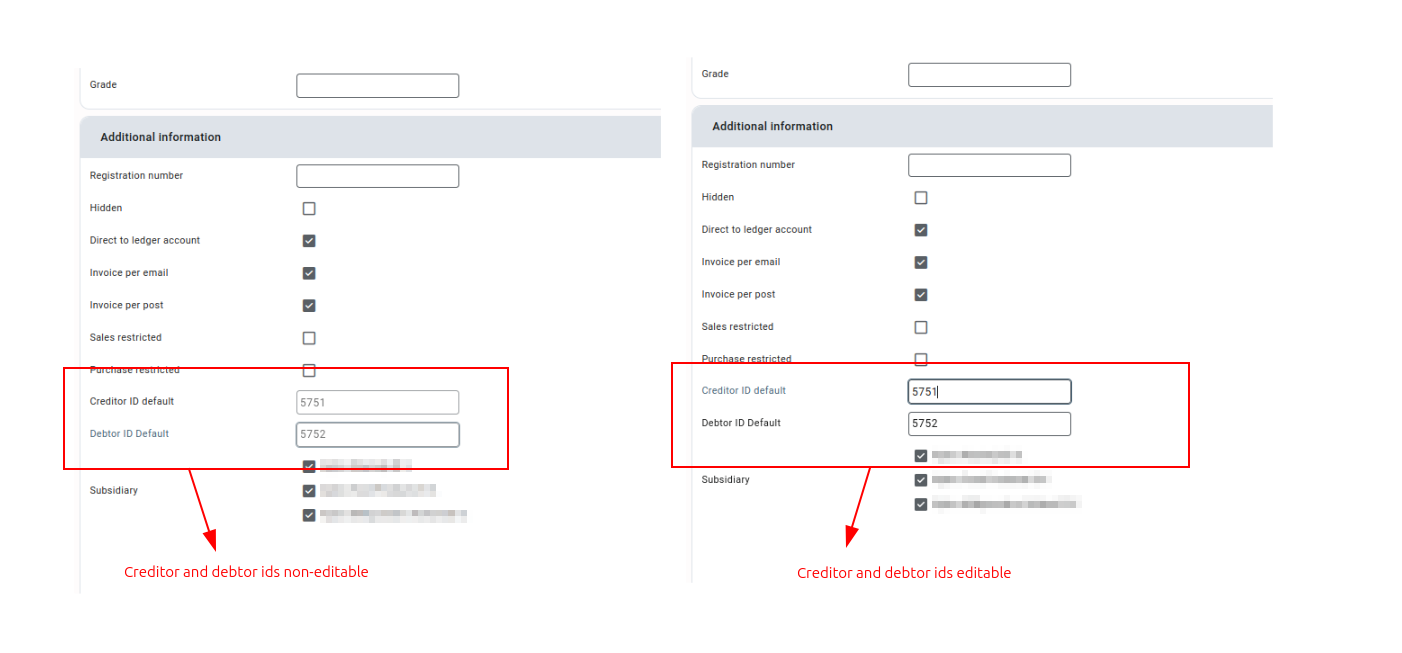

- Manual Debtor Creditor Numbers: Enabling this option makes the debtor and creditor numbers of relation editable. The debtor and creditor numbers are auto-generated but can be edited and saved again, while if the option is not enabled, these debtor and creditor numbers are auto-generated and cannot be edited.

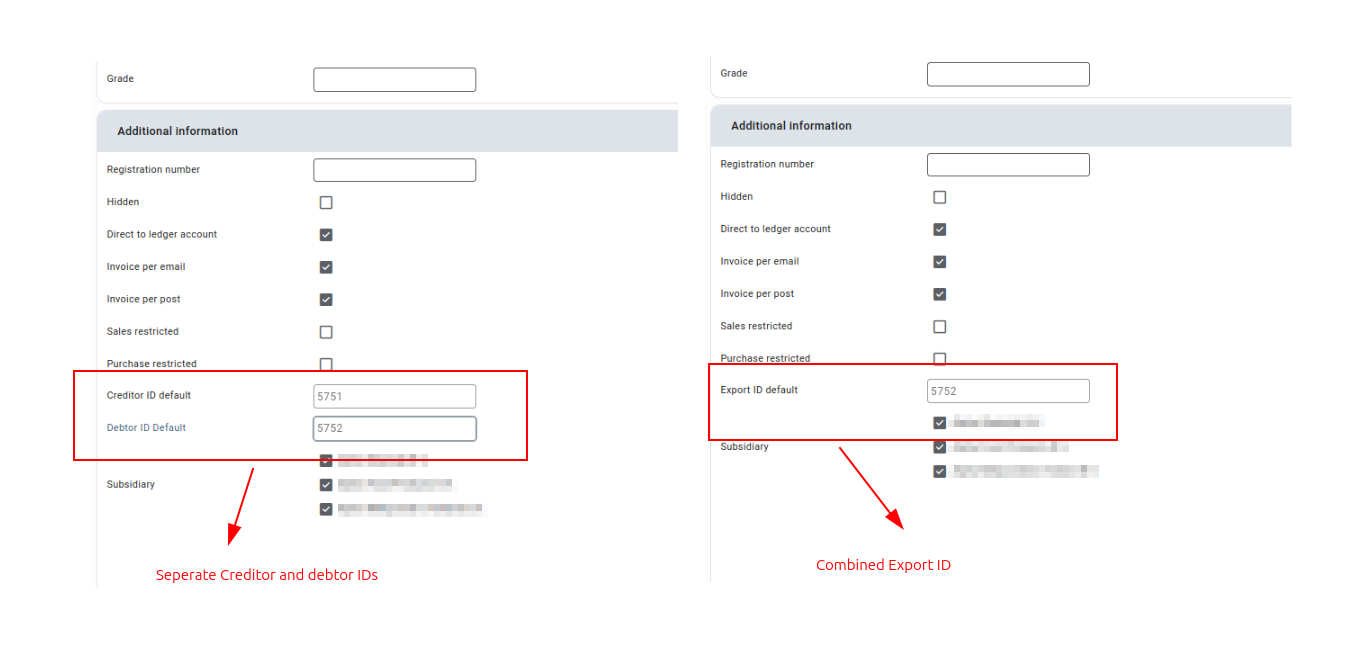

- Separate Debtor Creditor Numbers: This option allows you to choose whether a relation should have a combined export ID or separate credit and debtor IDs. If the option is enabled, there will be two different creditor and debtor IDs for the relations. If disabled, for a relation there will be a single combined export ID.

- Automatically Send to Accounting Software: This option automatically sends your invoices and bookings to Exact Online upon exporting from Qbil-Trade. This eliminates the need to manually download the XML file and import it into Exact Online. Instead, you will get an overview of invoices and bookings that have successfully been imported into Exact Online and which have not been on the Export screen. Any records that were not imported will show an error message detailing the reasons for the import failure.

Please note this option is specific to the accounting software “Exact Online” and thus will be available for businesses using “Exact Online” for accounting purposes. - Include header amount attribute: The option, when enabled, includes the header amount during the invoice export process. The header amount attribute includes “Currency Code” and “Value” (total invoice amount) for the exported invoices. In the case of invoices with foreign currency used, the “exchange rate” is also included in the header amount.

Please note this option is specific to the accounting software “Exact Online” and thus will be available for businesses using “Exact Online” for accounting purposes. - Supports Financial period: The setting is replaced by the screen Manage Periods which is enabled for all customers.

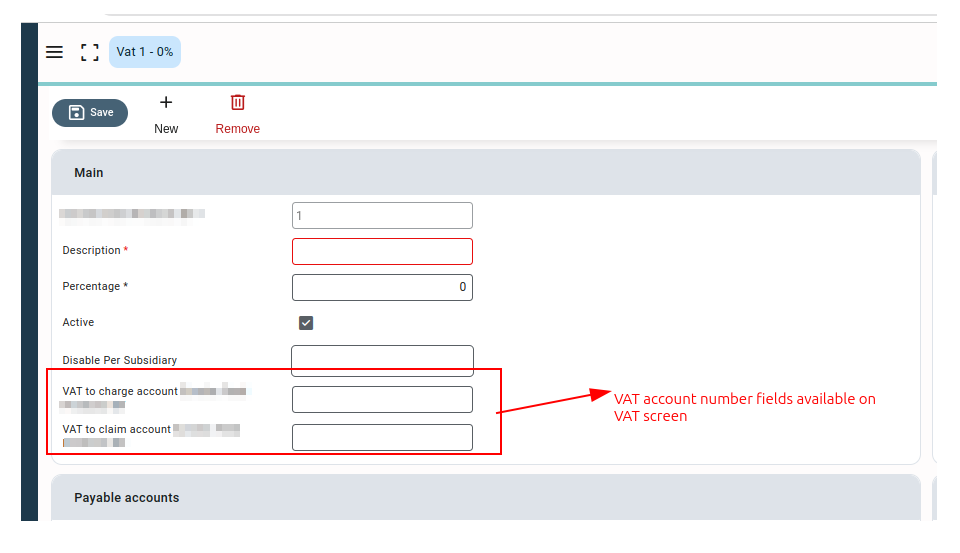

- Used VAT account numbers: Once the option is enabled, the VAT screen will display two additional columns: “VAT to charge account” and “VAT to claim account.”. These columns allow you to add VAT account numbers for purchase and sales invoices, respectively. For the accounting setup, these account numbers will become mandatory for the VATs used in invoices during export. This means that to successfully export invoices, you must fill in the account numbers for the VATs used. If these account numbers are not provided, Qbil-Trade will produce an error, and the invoices will not be exported.

Please note this option is specific to the accounting software “Cash View Export” and thus will be available for businesses using “Cash View Export” for accounting purposes.

- Use display number with CDATA: CDATA is the custom (extra) data that is displayed in the exported invoices. This custom data varies from customer to customer as per their requirements. The option, when enabled, uses the full display number in the CDATA of the invoice in the exported file.

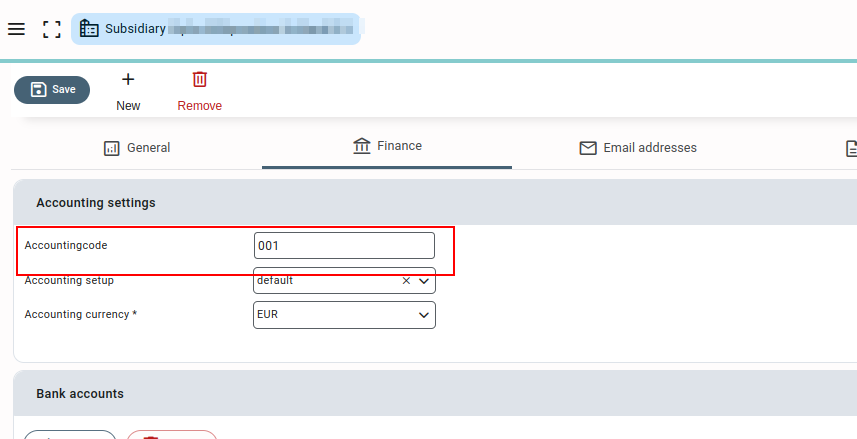

Please note this option is specific to the accounting software “Exact Online” and thus will be available for businesses using “Exact Online” for accounting purposes. - Needs Administration Number: When this option is enabled, the accounting code (administrator number) of the subsidiary (Finance setting of Subsidiary ) must be entered when exporting its invoices. If the accounting code for the subsidiary is not provided, the invoices will not be exported. A warning message will be displayed, indicating that the administration number is missing.

Please note this option is specific to the accounting software “Exact globe” and thus will be available for businesses using “Exact globe” for accounting purposes.

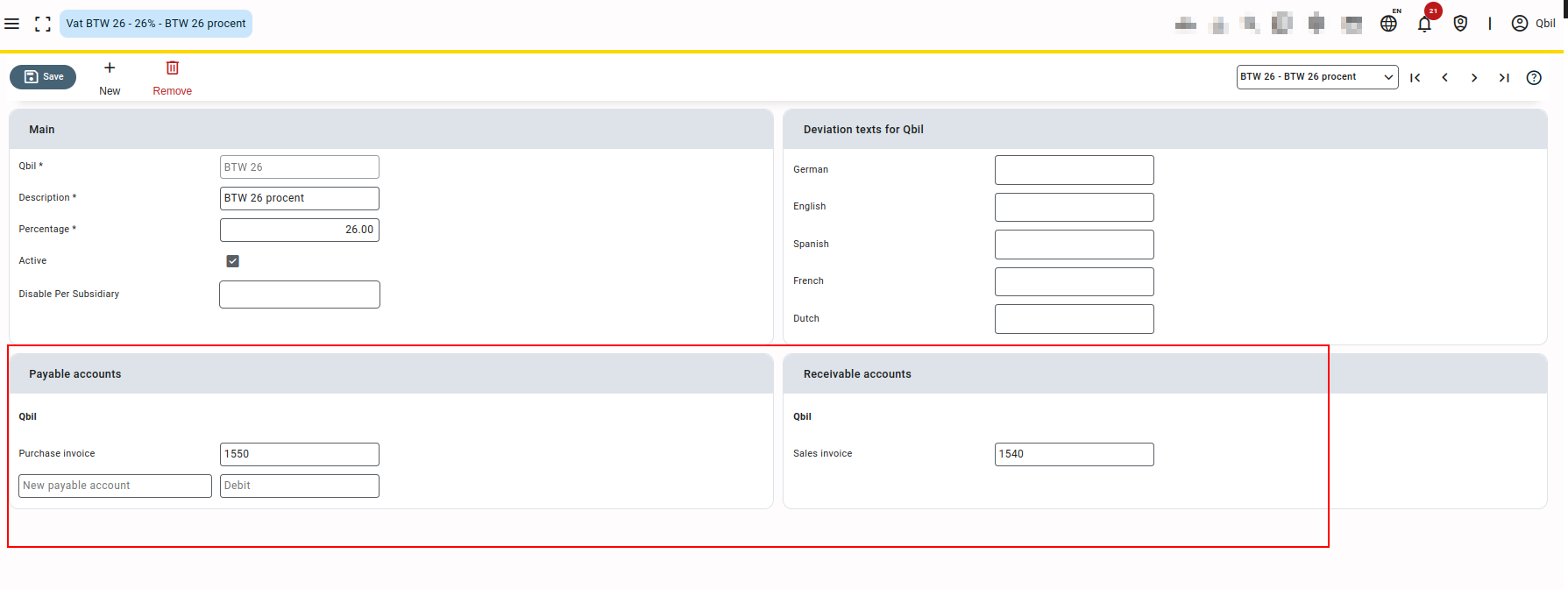

- Use ledger accounts for revenue and costs. Enabling this option checks whether a ledger account is associated with the VAT used in the invoice while exporting. If no ledger account is associated with the VAT used in the invoice, the invoice is not exported, and a message is displayed on the export screen implying that the ledger account is missing for the invoice. If the option is not enabled, no such check is implied when exporting the invoices.

- Should drop zero prefixes for invoices: When you enable this option, the starting zero from the invoice numbers will be removed during the invoice export process. This feature is only applicable if your invoice numbering scheme begins with “0”. By removing the leading zero, it will be easier to match the invoice numbers from Qbil-Trade with your accounting software.

Please note this option is specific to the accounting software “Exact globe” and thus will be available for businesses using “Exact globe” for accounting purposes. - Use the contract number with your reference for sale invoices: Enabling this option will display the “sales contract” as Your Reference on the exported sales invoice. If disabled, the exported sales invoice file will display the “Sales invoice number” as Your Reference.

Please note this option is specific to the accounting software “Exact globe” and thus will be available for businesses using “Exact globe” for accounting purposes.