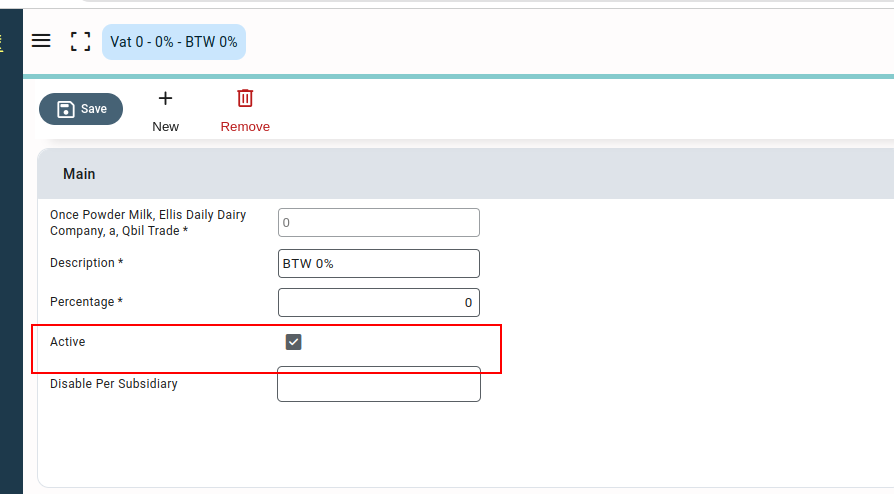

If you would like to archive a VAT code so it can no longer be used for new invoices or other documents, you can use the ‘active’ checkmark function in the VAT root data screen. This archives the VAT code in such a way that the data is still present in Qbil-Trade, but it no longer appears as a usable VAT code for future invoices.

Qbil-Trade does not allow deleting a VAT code that is still in use. If a VAT code is still in use in any type of mutation it will not be possible to delete it. This is to maintain traceability within Qbil-Trade and prevent error messages from happening because of missing data.

Steps to perform this action #

- Go to the VAT root data screen.

2. Unmark the checkbox ‘active’ and press save.

The VAT code is now inactive and will not be usable for future contracts.