General Description #

Numbering schemes in Qbil-Trade can be used to assign unique identifiers to various mutations, such as orders, invoices, offers, contracts, etc., as per your requirements. Number scheming usually helps in tracking and managing different aspects of your trading activities, like the status of orders, the position of a lot, etc.

In Qbil-Trade, a sequential numbering scheme is implied, which means that each mutation is assigned a number that follows the previous number in a pre-determined sequence. For example, in a sequential numbering scheme, the first mutation (let’s say order) will be assigned the number 1, the second order will be assigned the number 2, the third order will be assigned the number 3, and so on. You can also add a prefix for the numbering sequence for example for sales contracts, you can add the prefix “SC” or any other similar character to help easily distinguish between the various mutation types. Similarly, you can also add the year in the prefix to easily track the mutations from different years.

You can also use different numbering schemes for multiple subsidiaries to clearly distinguish between the mutations of multiple subsidiaries. Sometimes the business units have multiple VAT numbers (country-wise) for a single subsidiary. Qbil-Trade lets you set up a different numbering system for each of your subsidiary’s VAT numbers. This makes it easy to tell them apart and handle documents and financial procedures.

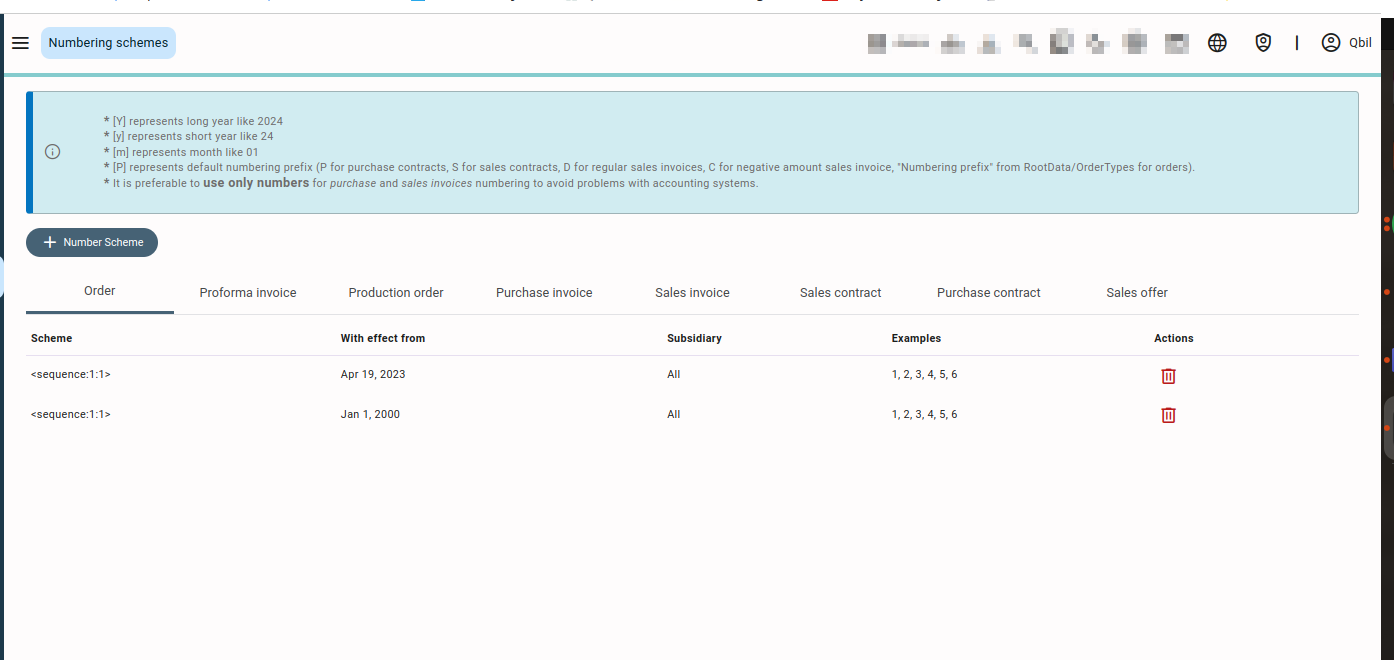

On the numbering scheme screen, you can also see the details of your current numbering scheme for various mutations like orders, production orders, contracts, invoices, etc.

Add a new numbering scheme #

- Select the Numbering Scheme in the Adminstration menu.

- Select the tab of the mutation type, for example, purchase contract, sales contracts.

- Press or Click “Number Scheme”.

- Add the various details in the mandatory fields of the numbering scheme.

-

- Scheme: Here you can determine the starting number for the new scheme. This will depend on how you want the numbers to be assigned. For example, you might start at 1000, or use a number that corresponds to a particular event or date. You can add any specific event like a year or month in the prefix. Any letter corresponding to the mutation type or subsidiary selected can also be added in the prefix section. The prefix added will be included in all the serial numbers generated in your numbering scheme.

- With effect from Here, you can choose when the numbering scheme should begin. You can only choose dates after today.

- Subsidiary: Here you can select the subsidiary for which the numbering scheme should apply (If your organization has multiple operational subsidiaries). You can also select the common numbering scheme for all of your subsidiaries by selecting “All” in the drop-down.

For subsidiaries with multiple VAT registration numbers, you can select the numbering scheme for a specific VAT registration number also. This is usually preferred for the invoice’s numbering scheme.

- Press or Click “Save” and the new numbering scheme will be added.

After saving, you will also be shown a few examples of the numbers that will be generated as per your newly added numbering scheme.

Before using a new numbering scheme make sure that your numbering scheme is working correctly by testing it on a sample mutation.

Additional information #

Before adding a new numbering scheme, there are several points to consider:

- The numbering scheme can be accessed and added only by users with admin permissions set to “Delete.”

- The numbering scheme will not apply to the mutations whose creation date is set before the “with effect from” date selection of the numbering scheme.

- The numbering schemes are non-editable. You cannot make any changes to a numbering scheme after saving.