General description #

RSO or Read Soft Online is an automated Scan and recognition system designed specifically to book invoices automatically. It focuses on making the invoicing process more user-friendly and time-efficient compared to the manual process of booking invoices.

Qbil-Trade in collaboration with Kofax AP Essentials(RSO) offers its users this integrated solution where users can upload invoices received by mail or scanned documents onto the Kofax AP Essentials platform. The invoices are then scanned, compared(to master data) and verified manually by the user to ensure accuracy. Once the verification process is complete, the invoices are fetched to Qbil-Trade for further processing and matching.

In Qbil-Trade, the data from the invoices are matched against the invoice data, such as supplier details, relation details, subsidiary details, currency and invoice amount. This matching process helps identify the corresponding expected invoices within the system. The details like supplier, exchange rate, VAT details etc, are regularly updated to the Kofax AP Essentials for easy recognition and verification of data from the incoming invoices.

If a match is found between the uploaded invoice in Kofax and an expected invoice in Qbil-Trade, purchase invoices are created and associated with the expected invoices automatically, streamlining the invoice processing workflow. On the other hand, if the data from the invoice is not recognised, the system rejects the invoice, and the user receives the status on Kofax AP Essentials and a notification (mail) based on their configured settings. In such cases, users can manually match these rejected invoices and export them to the Qbill-Trade.

By implementing this solution, businesses can reduce the manual effort required for invoice matching and booking, improving efficiency and accuracy in the invoice processing cycle. It provides a streamlined approach for handling a large number of invoices, minimizing errors and saving valuable time for finance teams.

How does it work #

For each individual client, a minimum of two distinct types of accounts admin user and the regular user exist within the RSO framework.

The admin user has the ability to access and review all the master data (suppliers’ details, VAT details of suppliers and subsidiaries, currencies, payment conditions, etc.) stored within the RSO. This admin account tracks and manages the master data uploaded on RSO from Qbil-Trade which is updated periodically.

The admin user can also add multiple regular and admin users and set their access privileges.

The regular users are added by the admin users who are responsible for uploading/scanning the documents and verifying these invoices. which are later exported to the Trade for matching and further processing explained below.

Invoice Recognition #

In this step, the invoices received are uploaded and the data from these invoices is recognised to create the booking invoices. The process includes the following steps:

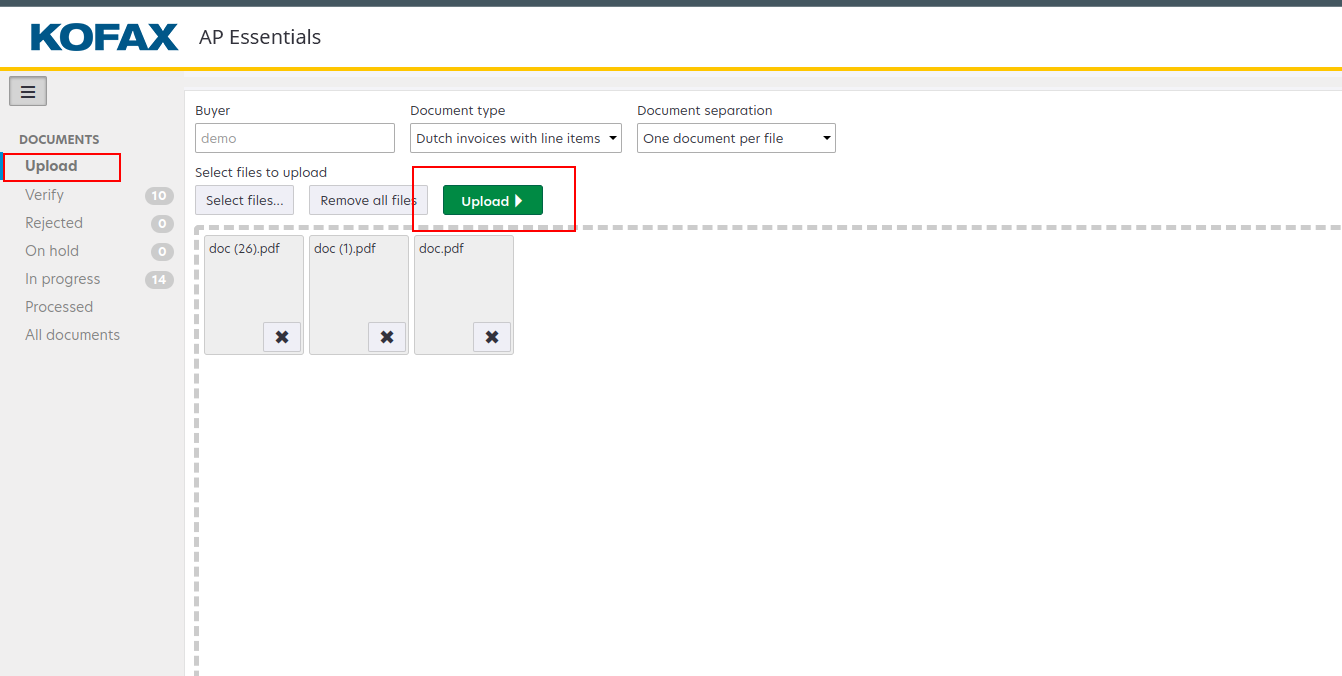

- Uploading Incoming Invoices: Invoices can be uploaded to the Kofax AP Essentials software in various ways, such as via a dedicated mailbox for each administration, scanning invoices directly to the mailbox or folder, or uploading files from a folder.

- Data Recognition: The software uses OCR technology to recognize and extract data from invoice headers and line items. Key information such as supplier name or number, VAT number, invoice lines and amount are automatically identified.

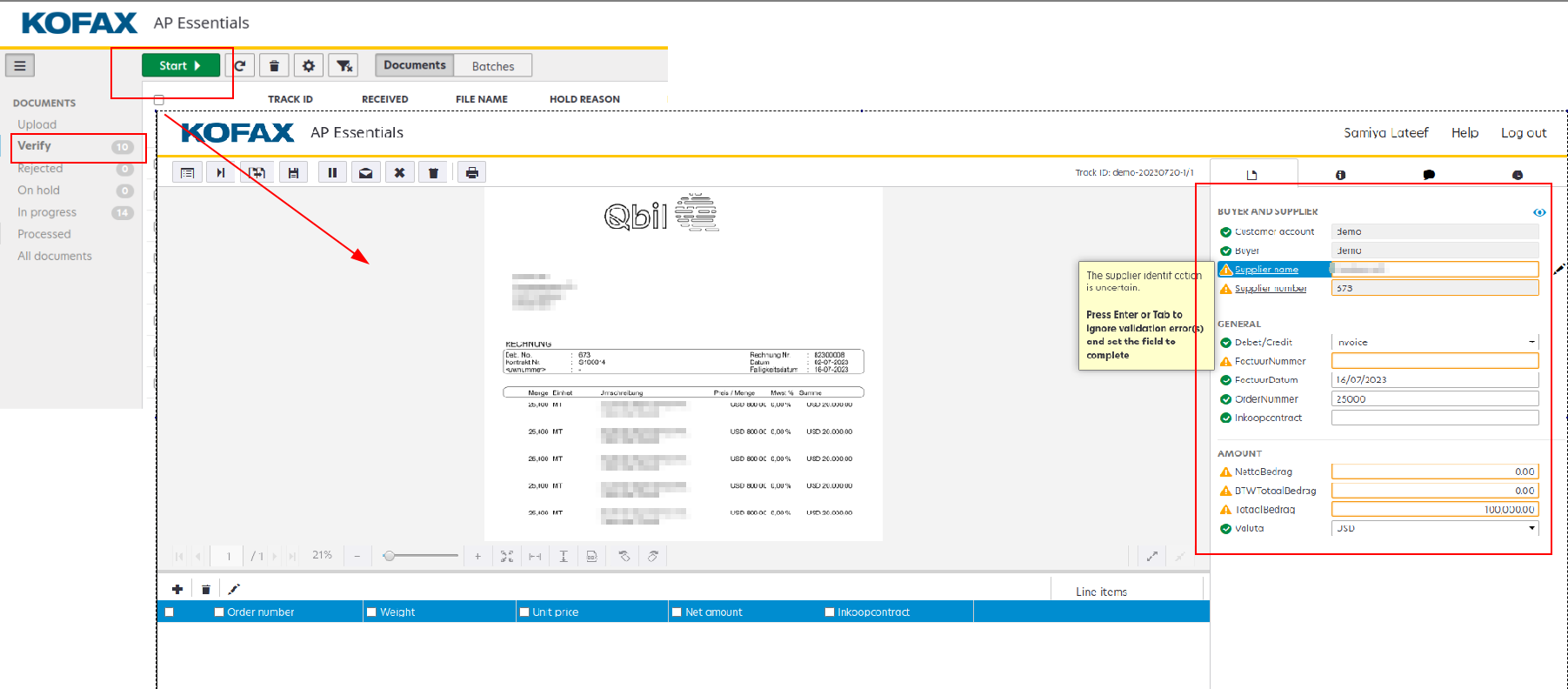

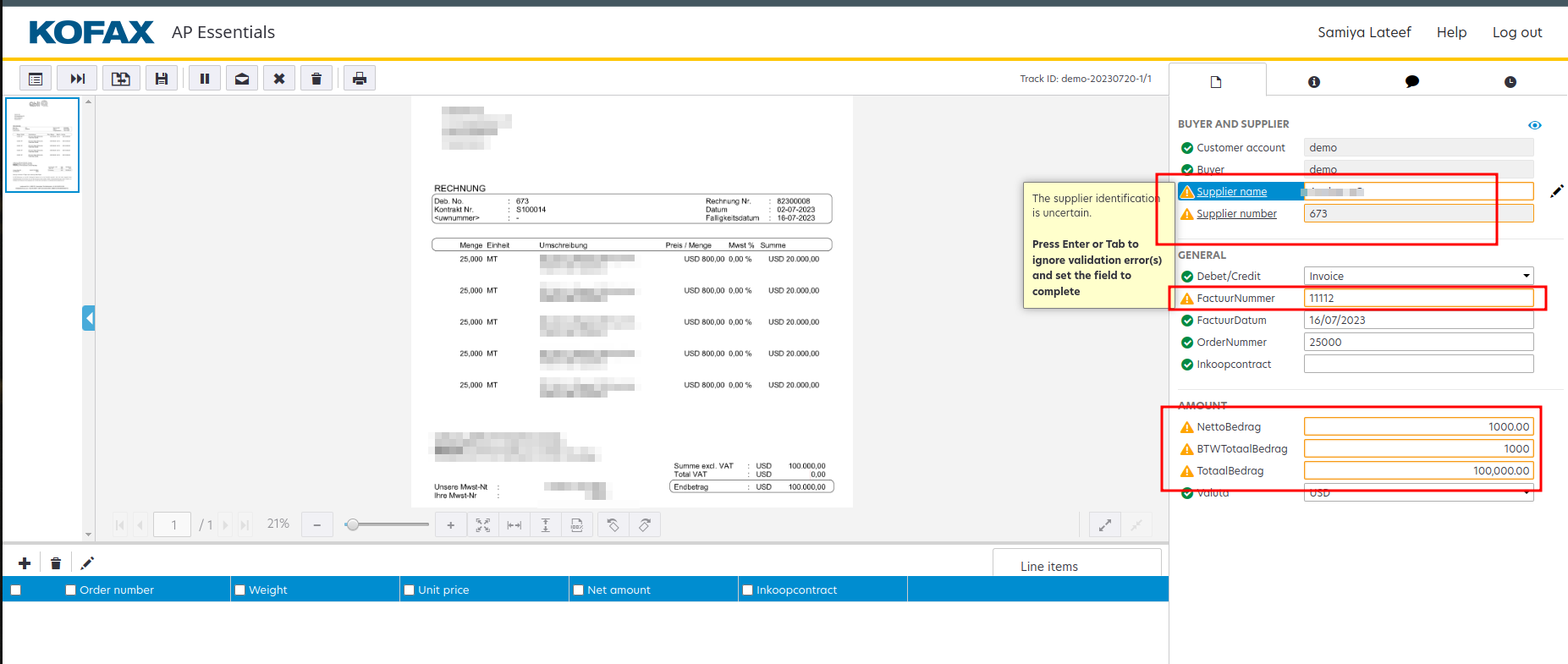

The relation data and VAT numbers of relations are regularly updated from Qbil-Trade to Kofax AP essentials for easy data recognition. - Verification of Data: The user manually verifies the various details using the verify tab to review, and confirm the data extracted from the invoices. This step allows users to ensure the accuracy and completeness of the recognized data.

All the invoices that are not verified yet can be checked in the “Verify” tab.

If the data for the various fields doesn’t match, those fields are highlighted in orange with a warning symbol.

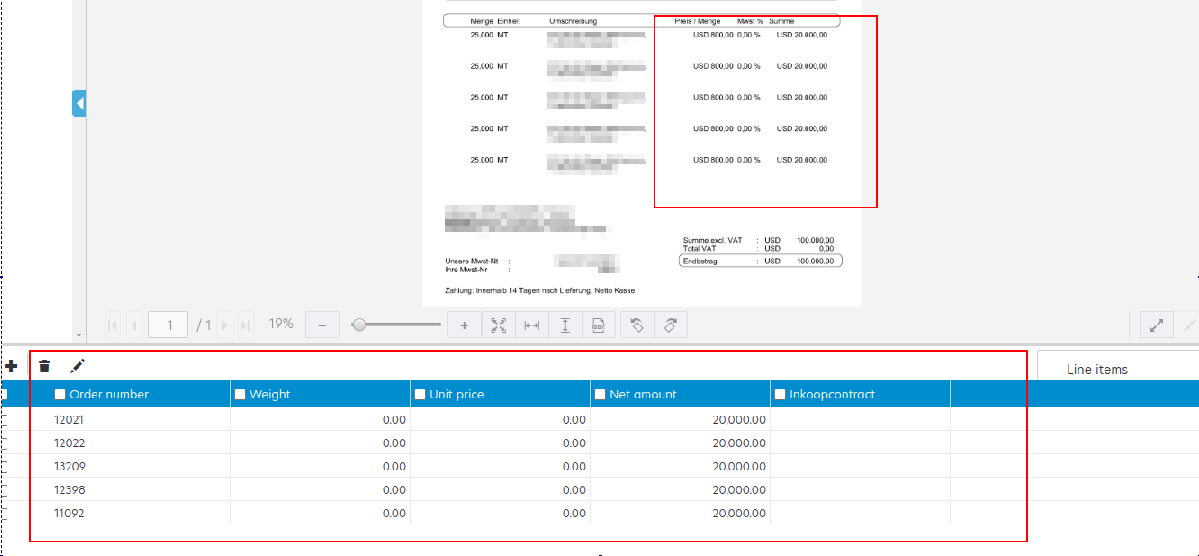

Apart from the data fields in the generic section for one invoice line, you can also add the data if multiple invoice lines are included in any received invoice using the line items.

- Exporting Invoices to Qbil-Trade: The recognized and validated invoice data can be converted into the desired file format, such as XML or PDF. The converted files are then exported into Qbil-Trade for further processing and matching with the expected invoices.

Invoice creating and matching with expected invoices #

After verifying and exporting the invoices from Kofax AP Essentials the invoices are automatically fetched into Qbil-Trade and linked(assigned) to the relevant expected invoices after the matching process. Qbil-Trade creates the booking invoices and matches them with the expected invoices. The following points/conditions are considered while creating an invoice. The invoices that don’t meet the given conditions are not imported into Qbil-Trade and are rejected back to the RSO with a specific message.

- Supplier invoice number: The supplier invoice number of an invoice is checked. If no supplier invoice number is found for an invoice, the invoice is rejected.

- Invoice date period: The invoice date period is checked. If the invoice date falls within a closed period, the invoice is rejected.

- Date limitation: If the invoice date falls before the date limitation added for the purchase invoice, the invoice is rejected.

- Current year: The year of the invoice date is also checked. If the invoice date falls in the previous year, the invoice is rejected.

- Currency Exchange Rate: The availability of the currency exchange rate for the invoice is also checked. If the exchange rate of the currency used in the invoice is not available for the provided invoice date, the invoice is rejected.

- Numbering scheme: The availability of a numbering scheme is also checked. If no numbering scheme is active for the purchase invoice on the invoice date, the invoice is rejected.

- Subsidiary: If no subsidiary is associated with the invoice, the invoice is rejected.

- Relation/Creditor: If no relation/creditor is associated with the invoice, the invoice is rejected.

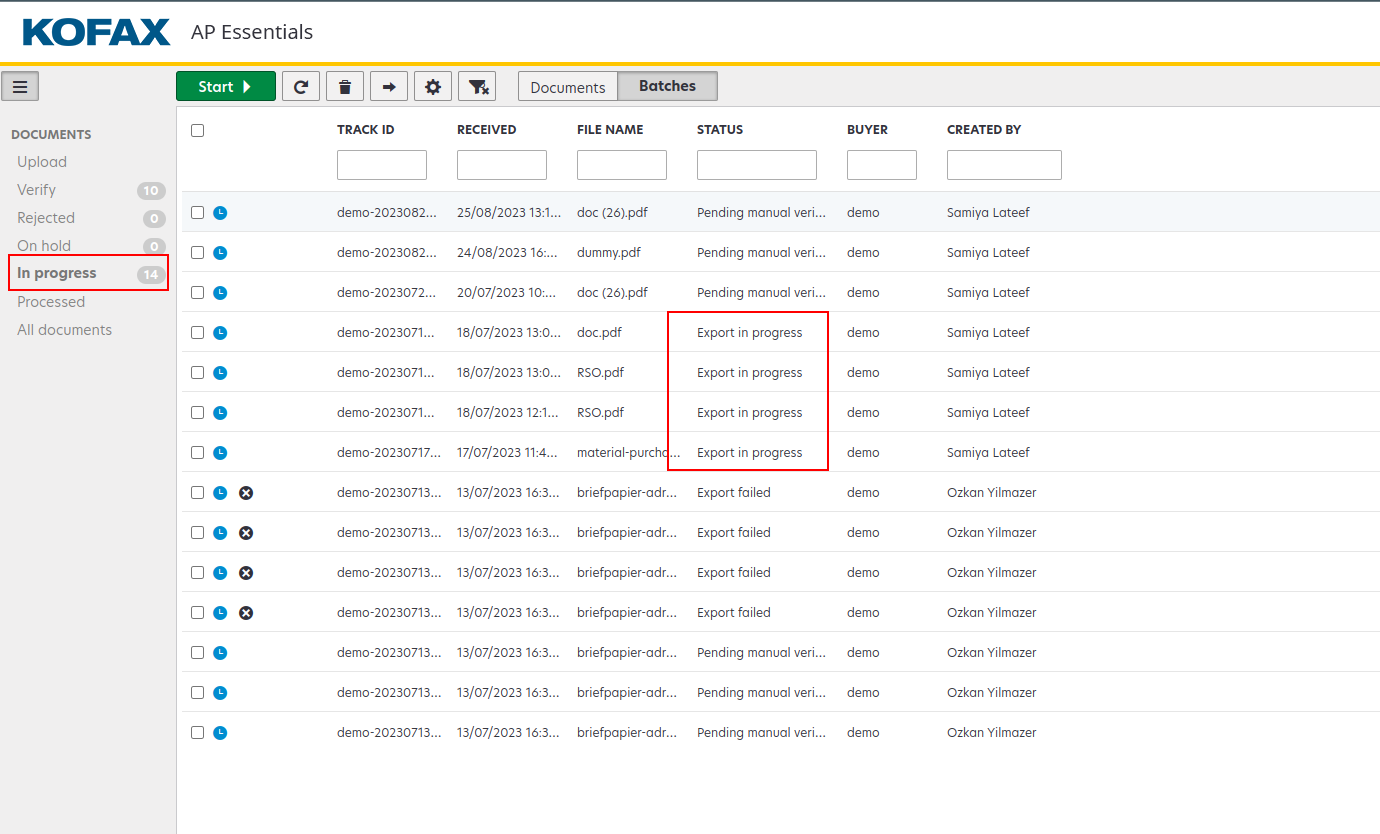

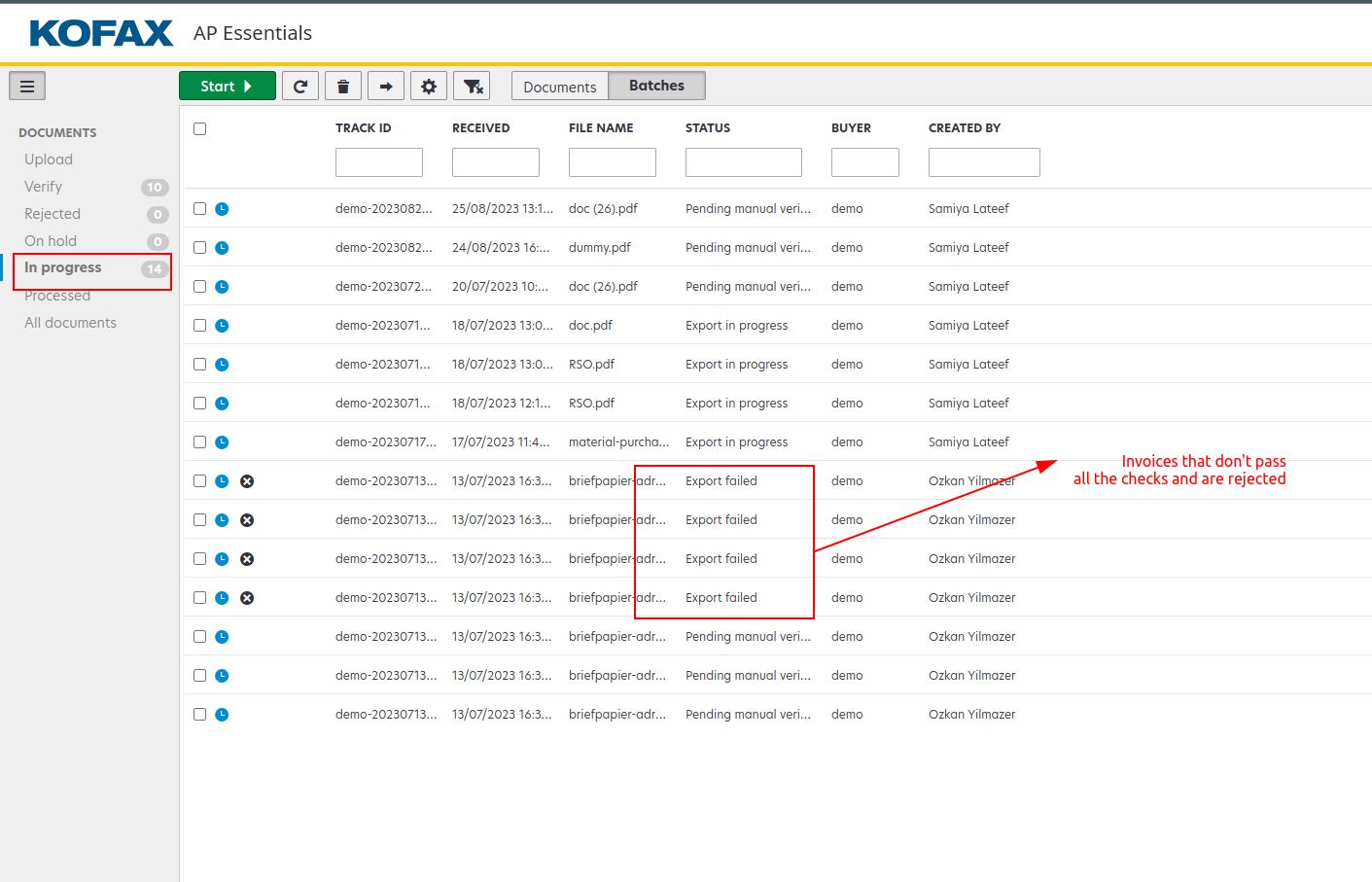

If for some reason, the invoices are not matched, the user receives the status on Kofax AP Essentials and a notification (mail) based on their configured settings. In such cases, users can manually match these rejected invoices and export them to the Qbil-Trade. Such invoices can be found with the status “Export failed” in the “In Progress” tab of Your RSO account.

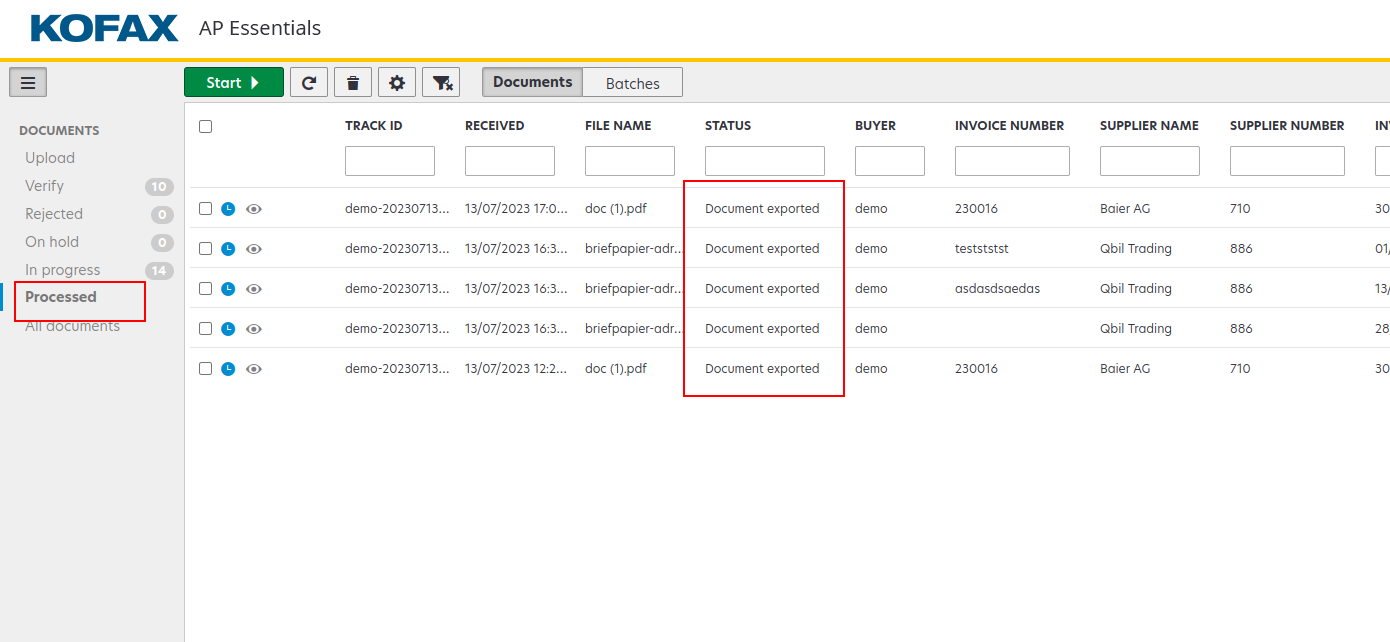

After an invoice is rejected, the matching continues without halting the whole process and affecting the other invoices. All the invoices that pass all these checks are successfully exported into Qbil-Trade. These invoices you can track in the tab “Processed” of RSO with the status “Document Exported.”

Once the invoices are retrieved from the RSO and booking invoices are generated, the next step is to associate (assign) invoice lines to their respective invoices, known as the matching process. Qbil-Trade undertakes this matching process by considering various criteria, including invoice amount, order numbers, creditor details, and purchase contract numbers.

The success of the matching process relies heavily on the accuracy of the information provided on the invoice. This automated matching and booking of invoices significantly reduces manual efforts, leading to enhanced efficiency in the invoice processing cycle.