General description #

A sales invoice is a document that is sent to a customer after a sale has been made in Qbil-Trade. This invoice is generated for goods or products that have been sold through a sales contract. The information on the sales invoice is based on the corresponding contract and order. The profit made from a contract is calculated according to the sales invoice.

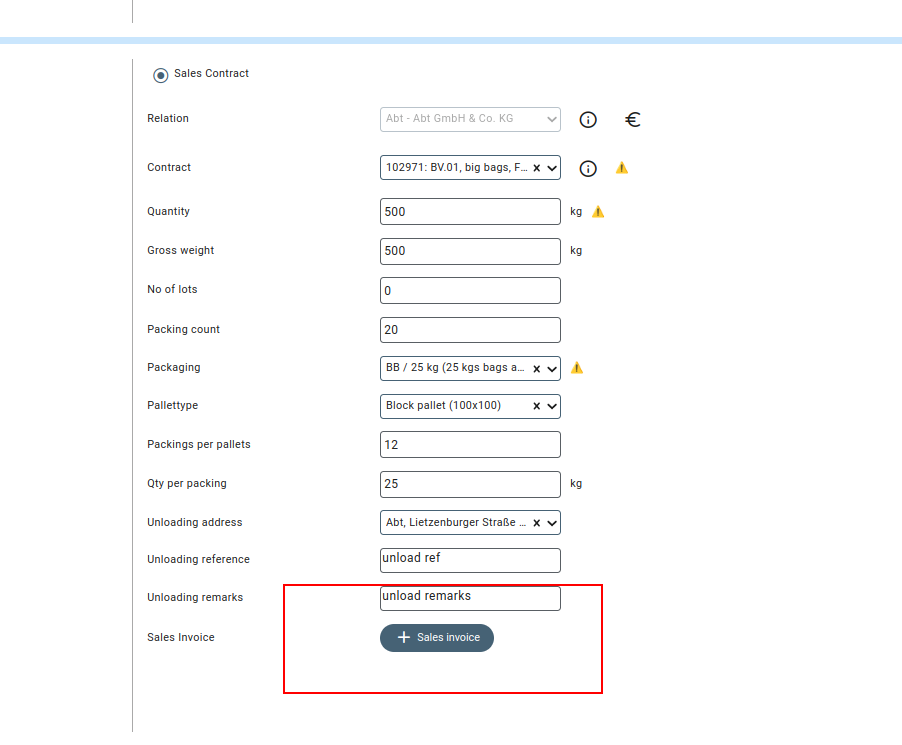

Create a sales invoice #

- Press or click the ‘Create’ button at the bottom of the order line (with the associated sales contract).

- Enter relevant data in the fields, or at least make sure to fill in all the mandatory fields marked in red.

- Press or click “Save”, and the sales invoice will be created.

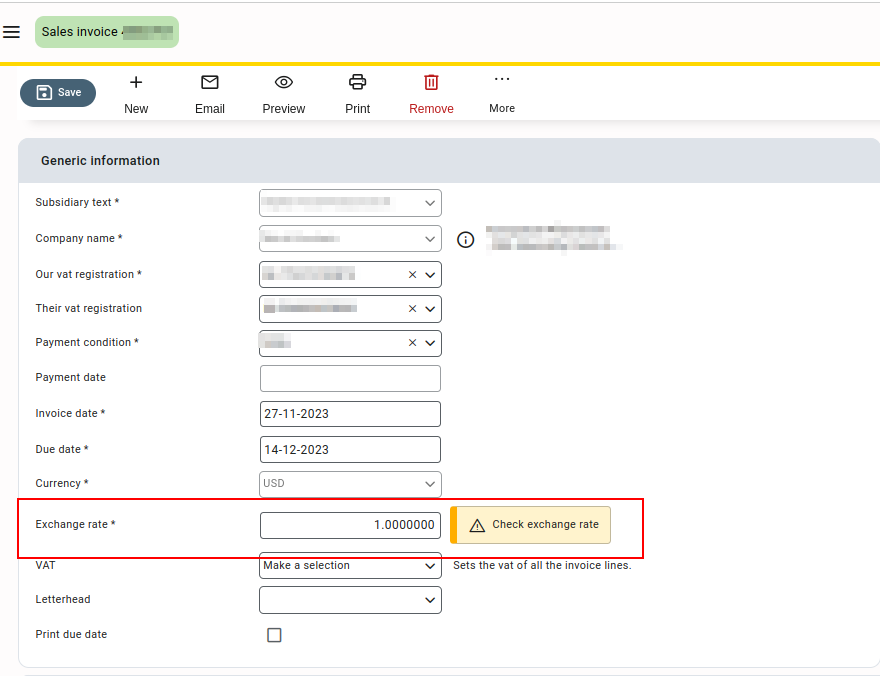

Exchange rate difference warning #

A warning “Check exchange rate” is displayed for the exchange rate field in the following scenarios:

- If the currency used in the invoice is the same as the base currency of the subsidiary associated with the invoice, but the exchange rate shows a value not equal to “1” or “1.000000.”

- If the currency used in the invoice is different than the base currency of the subsidiary associated with the invoice, but the exchange rate shows a value equal to “1” or “1.00000”.

- In some cases with required settings enabled, if the currency used in the invoice is not equal to the currency used in the associated contract, a warning “Check contract exchange rate” is displayed.

However, the sales invoices can still be saved even if the warning for exchange rate difference is shown, as the warning does not prevent the saving of invoices.

Please note this warning is displayed for proforma and miscellaneous sales invoices as well.

Handling dry matter #

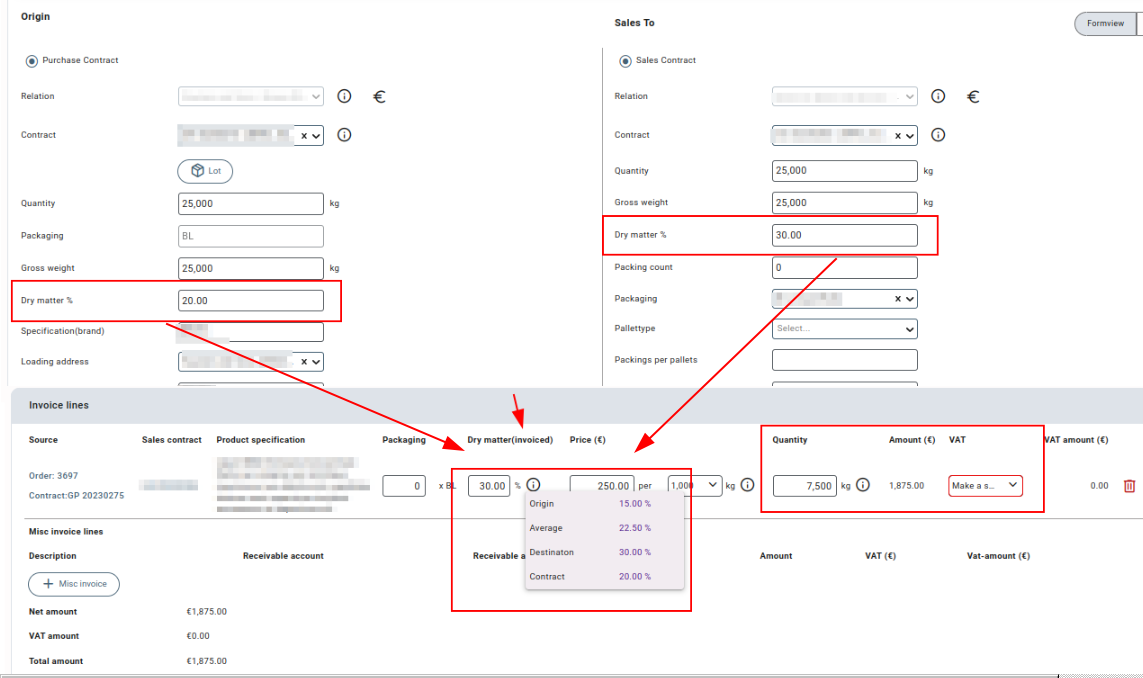

When it comes to contracts where dry matter is the pricing factor, the sales invoices will default to the dry matter content according to the destination side of the order. However, it is also possible to invoice based on other quantities such as the origin of the order, the contract, or even the average of both these quantities. If you hover over the percentage, all these percentages will be displayed for selection. You can also manually adjust the percentage.

For instance, let’s take the example of a delivery where the dry matter content was measured to be 20% at the origin of the orderline and 30% at the destination of the orderline. Qbil-Trade, by default, uses the percentage from the destination of the orderline (30% in this case) for invoicing in the dry matter (invoiced) column. However, you have the option to select any one of the other options provided, such as Origin, Average, and Contract. This selection made in the dry matter (invoiced) column affects the calculation of the values in the fields Quantity and Amount, which, in turn, affects the total amount of the invoice as well.

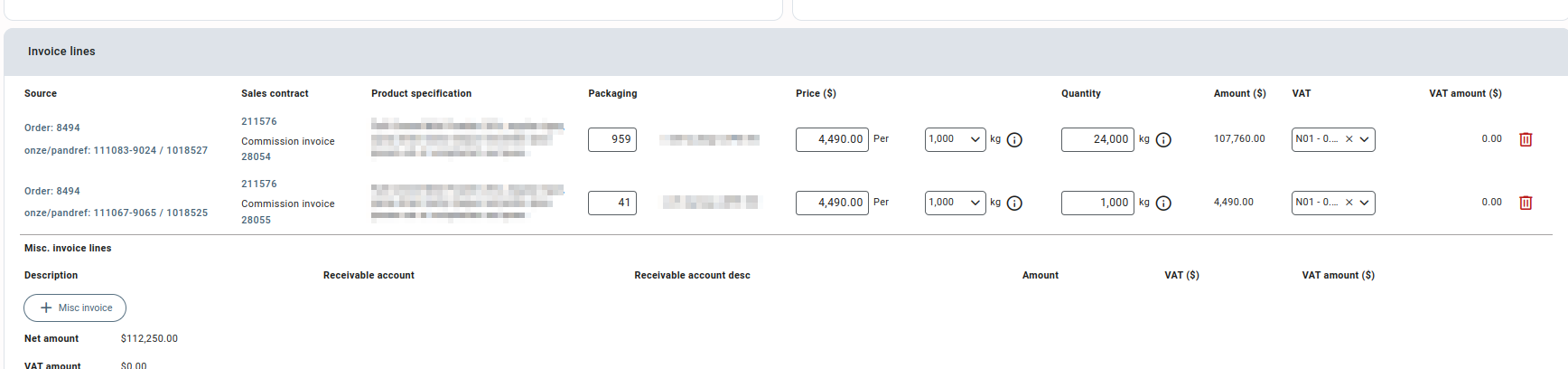

Multiple invoice lines #

You can add multiple invoice lines to a sales invoice. There are certain conditions for adding multiple invoice lines to a sales invoice.

- The order number should be the same.

- The sales contract should be the same.

- Contract quantity should not exceed.

- Sales invoices in which the user wants to add invoice lines should not be exported.

Adding multiple invoice lines #

- Open the order related to the sales invoice in which you want to add invoice lines.

- Add a new orderline, and fill in mandatory fields marked in red color.

- Press or click “Save”.

- Navigate back to the sales invoice of which you created the multiple invoice lines. The added invoice lines will be visible in the “Not yet invoiced” section at the bottom screen.

- Press or click the “Add” button and save. Added invoice lines will be added to the invoice lines section.

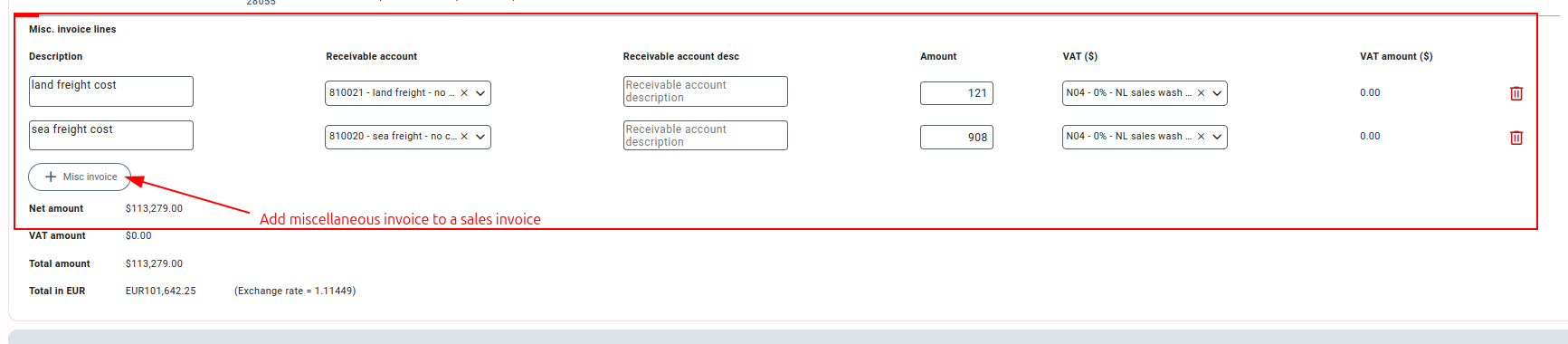

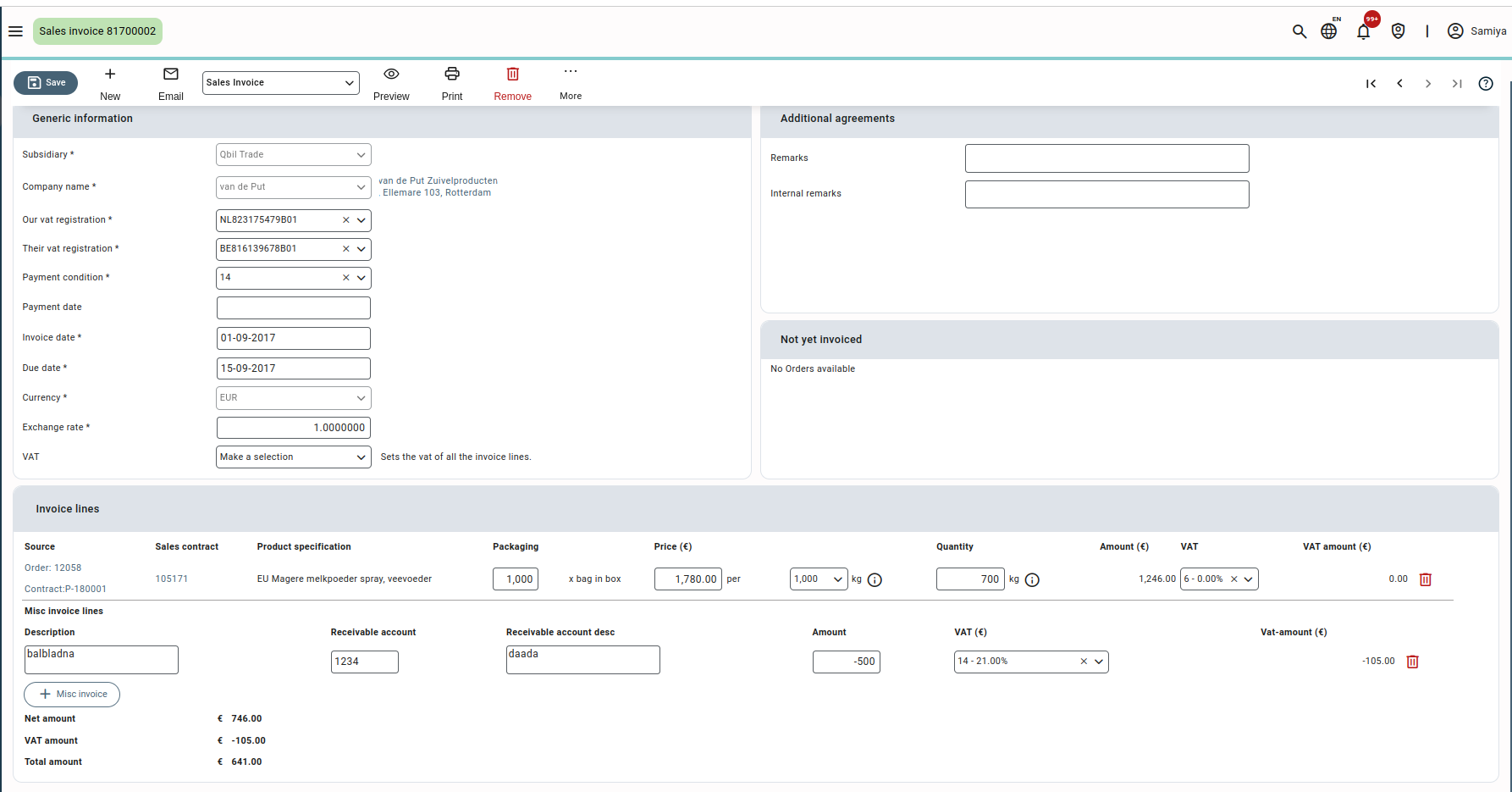

Miscellaneous invoice lines #

You can add any miscellaneous costs related to the sale by adding the required details in misc. sales invoice lines and saving the invoice.