If you are trying to delete an order but are unable to do so due to the associated orderlines, you must first remove the orderlines. To delete an orderline you also need to delete many other things related to the order/orderlines as mentioned in the steps below.

- Open the order you want to delete.

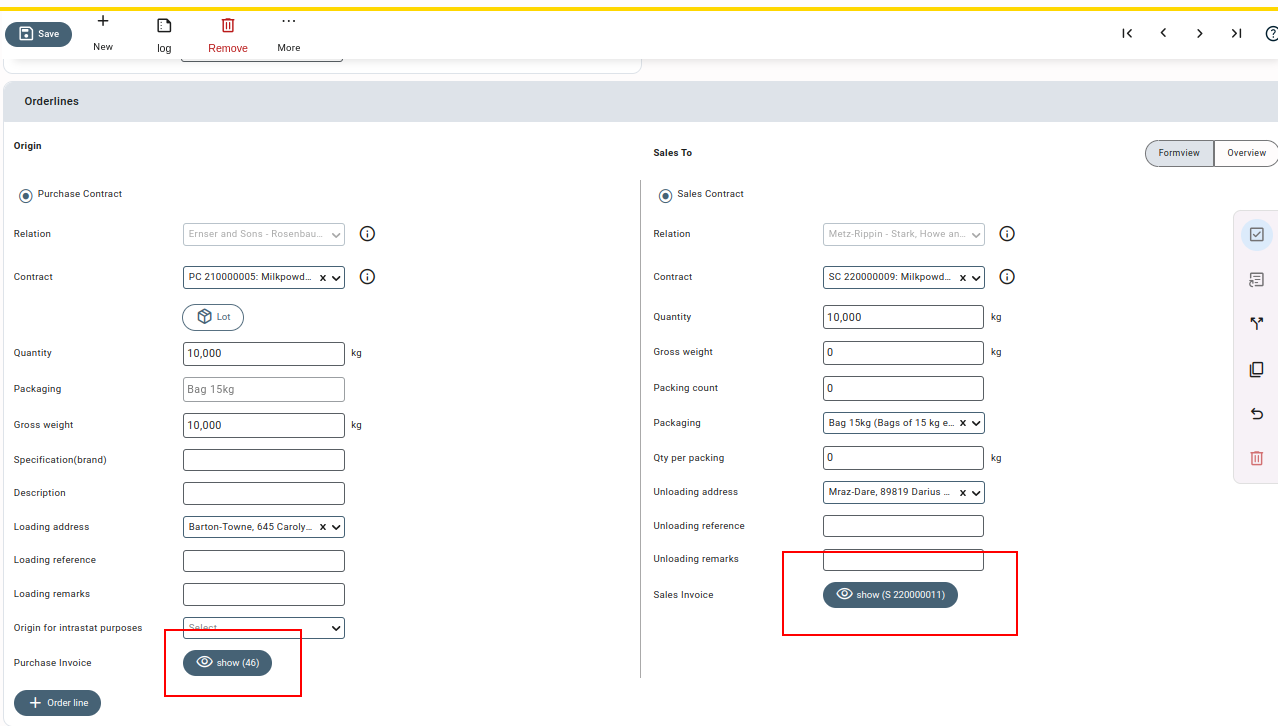

- Delete the purchase and sales invoices associated with the order line. You can delete the invoices by simply clicking the button on the order line that displays the invoice number and then clicking the “Remove” button on the invoice.

Before deleting the invoices, make sure the invoices are not exported. If exported, you need to first release the invoice in invoice administration to delete an invoice.

- After deleting the invoices associated with the order line(s), reload the order.

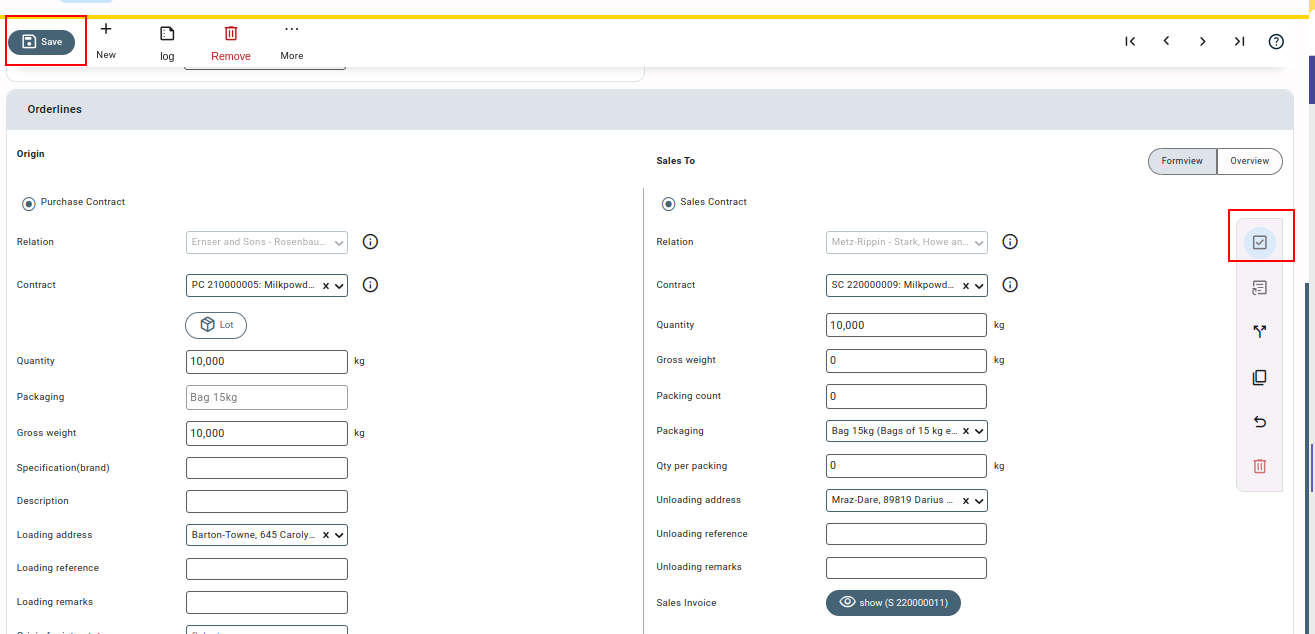

- Now release the order line by unchecking the “finalized” button (if the order line is finalized) and saving the order.

- After unfinalising the order, make sure the stock from the order (in the case of purchase or stock relocation orders) is not being used in any other order (back-to-back or sales order). If so, you need to delete the order line(s) using the stock first to remove this orderline and reload the order.

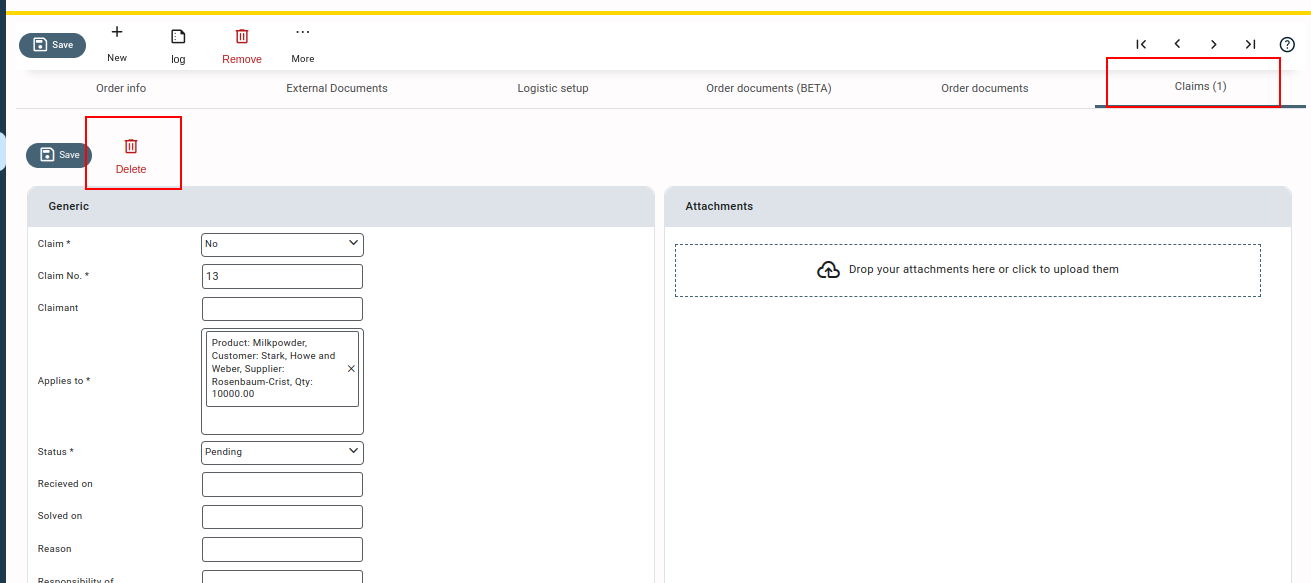

- One more thing to be considered while deleting an orderline is to check whether any claims have been added to the order. If a claim is associated, you can delete it using the Delete button on the claims tab of the order screen.

Please note that the claim is a configuration-based feature and needs to be checked only if the feature is enabled for your Qbil-Software setup.

- After deleting the claim, save the order.

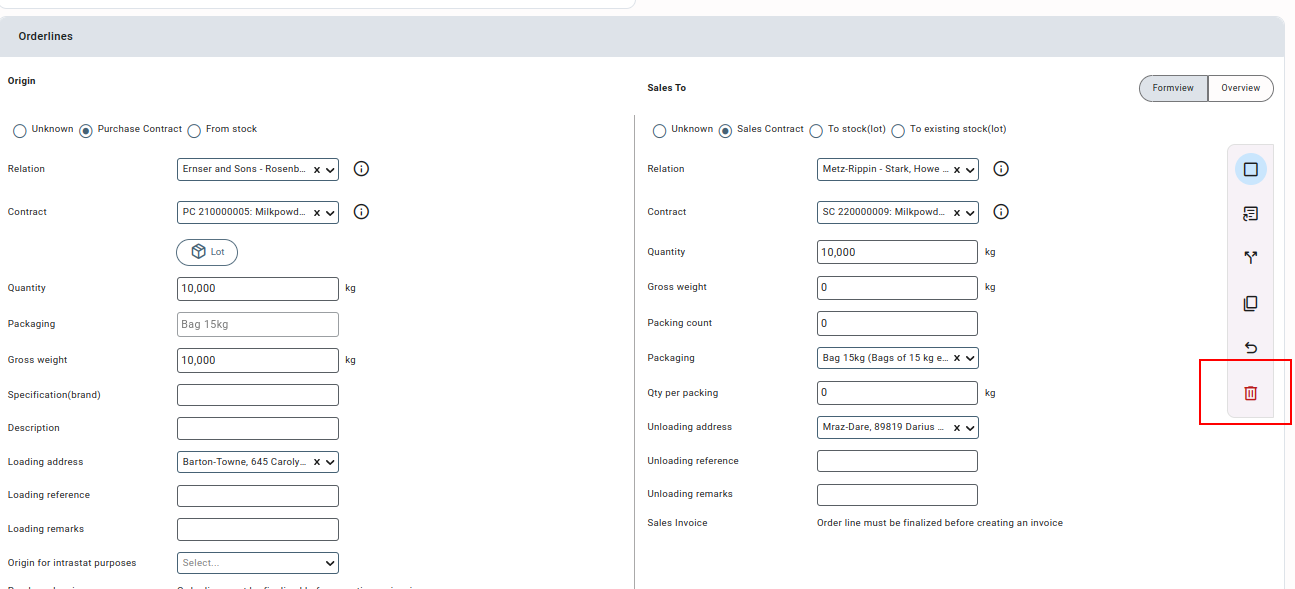

- Now delete the order line using the delete icon.

- After deleting the associated order lines, make sure that any order costs or transport orders associated with the order are deleted.

- Now try to delete the order, if all of the above steps are followed carefully, you will be able to delete an order successfully.