General description #

Currency hedging is used when a supplier wants to receive payment in a foreign currency or when a customer plans to pay in a foreign currency. Each transaction in a foreign currency carries financial risks, primarily due to fluctuating exchange rates. To avoid these risks, you can arrange with a bank to lock in the exchange rate for a set period. Since exchange rates can change in either direction, banks are willing to make these deals because they have a better understanding of how rates might move and are more likely to take on the risk. If you enter into a contract within the agreed period, the exchange rates will stay the same as initially agreed, protecting you from any financial loss. Once both parties agree on the terms, the transaction happens without any risk to your profits.

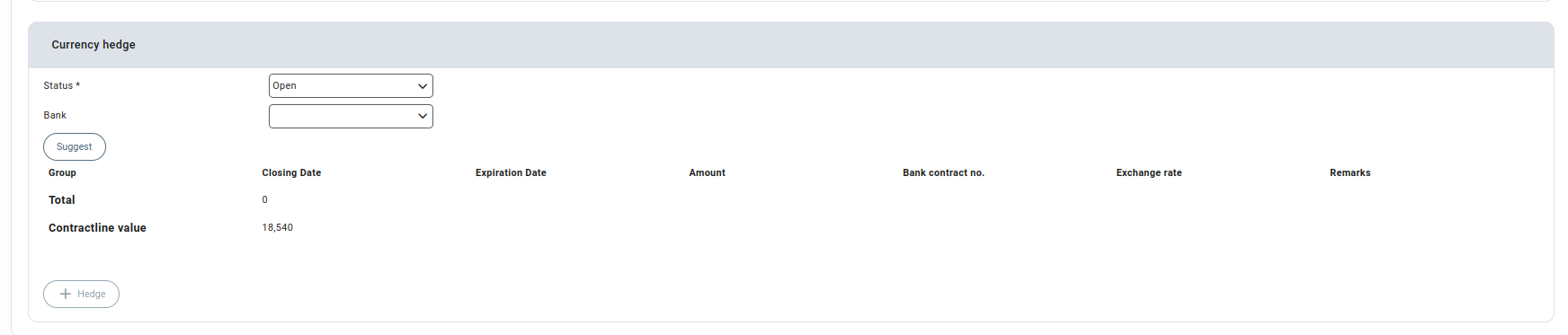

In the currency hedge section of the contract, you can link and add details of various hedging agreements. A single contract line can be connected to multiple hedging contracts. On the currency hedging screen, each hedging contract is shown as a separate entry.

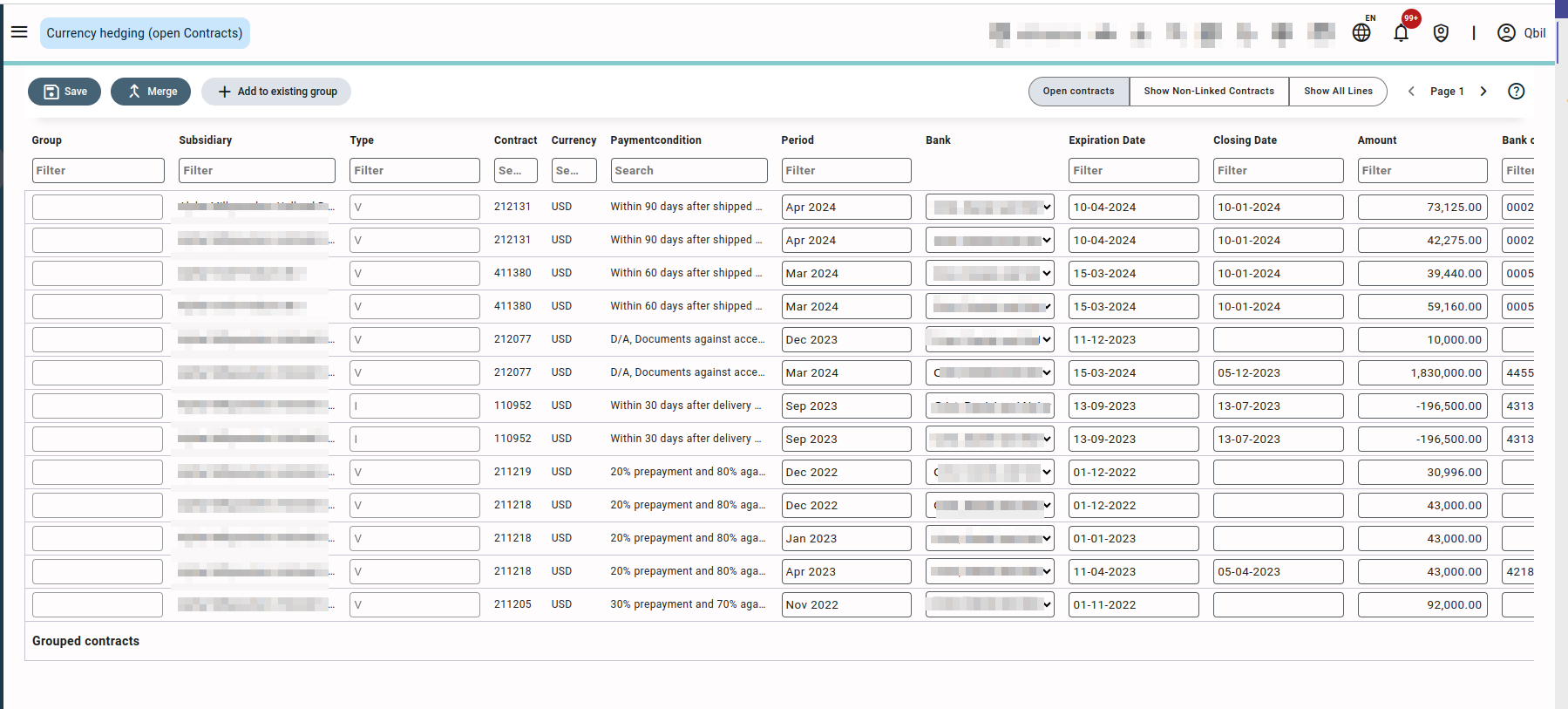

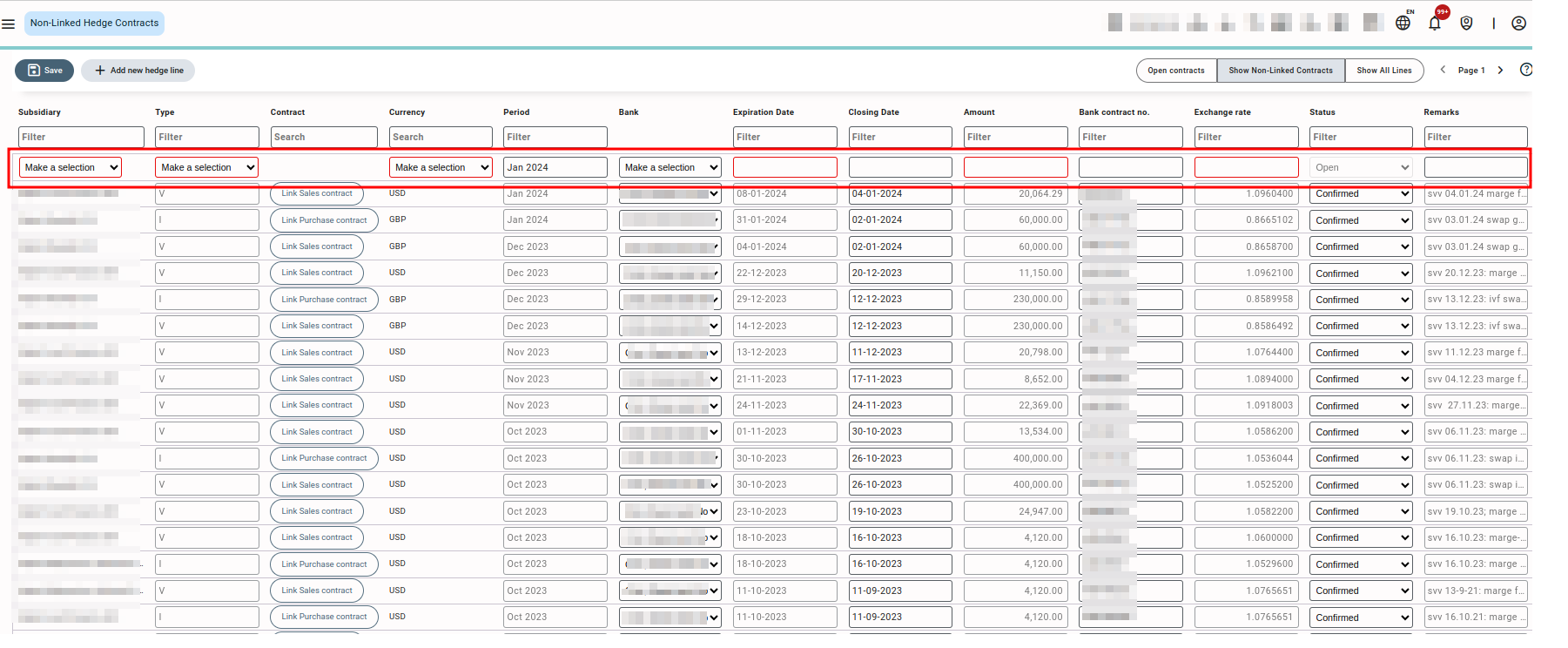

The currency hedging module displays all the contracts that have been hedged. You can also organize multiple contracts into groups based on similar characteristics, like the same currency and bank. You can add new hedged contracts to these existing groups. The module helps you see which contracts are already hedged and suggests which ones could be hedged. By using the merge feature, you can combine all the selected contracts into a single group.

Bulk hedging #

Bulk hedging helps you lock in favorable currency exchange rates. Here’s an example to explain: Suppose you need to sell USD in the future but don’t have a product contract with a customer to link to a bank (hedging) contract. If market conditions are favorable, you can negotiate a good exchange rate with the bank right now. Even without a product contract, you can secure the deal to take advantage of the current rate. Later, you can link a product contract (sales or purchase) to the bank contract you’ve already made.

Link non-linked hedge contracts to purchase/sales contracts: #

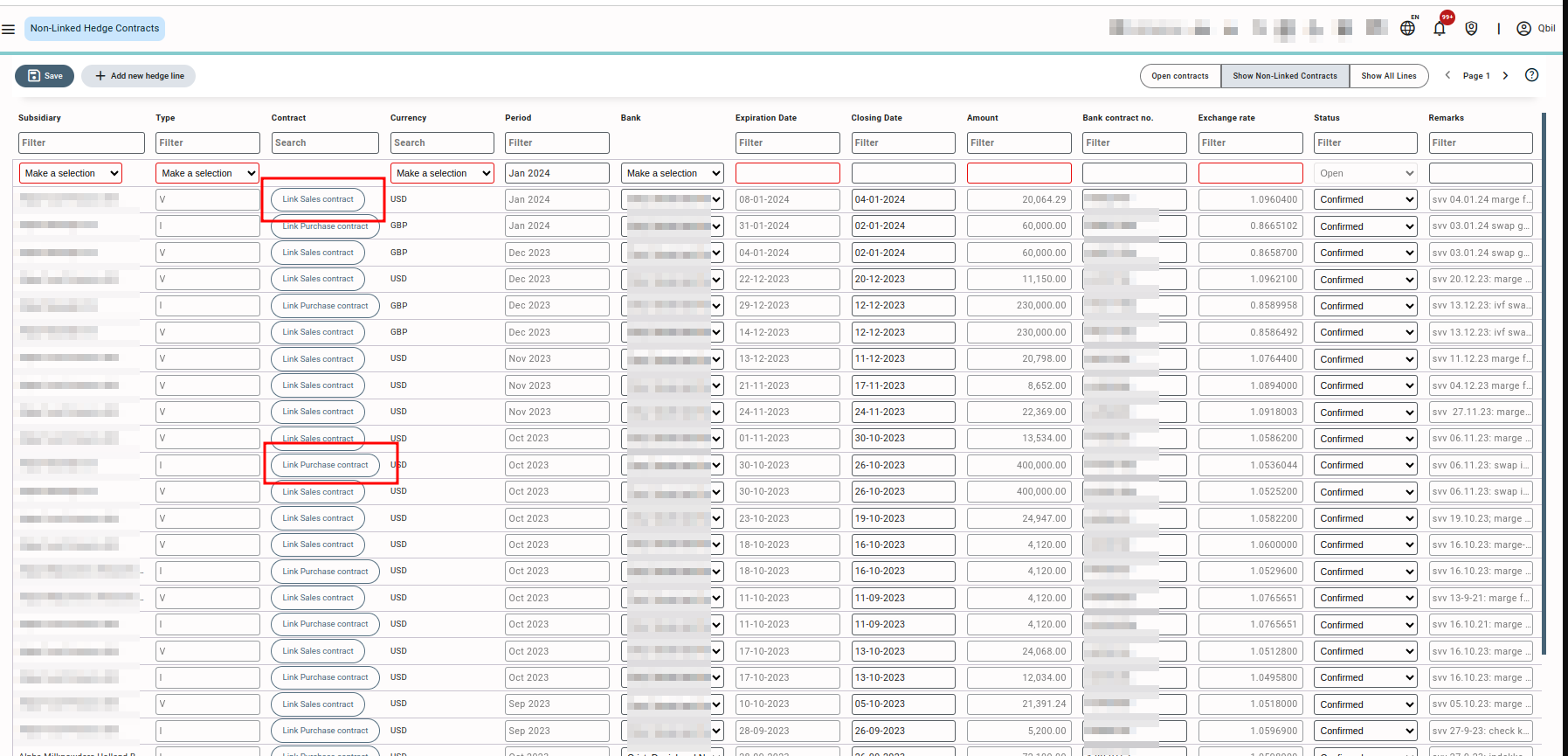

- Open the bulk hedge screen and select the option Show non-linked contracts.

- Add a new hedge line and fill in the required values.

- Save the hedge. You can link it to sales or purchase contracts later.

- Each new hedge line will appear separately but can be linked to sales or purchase contracts.

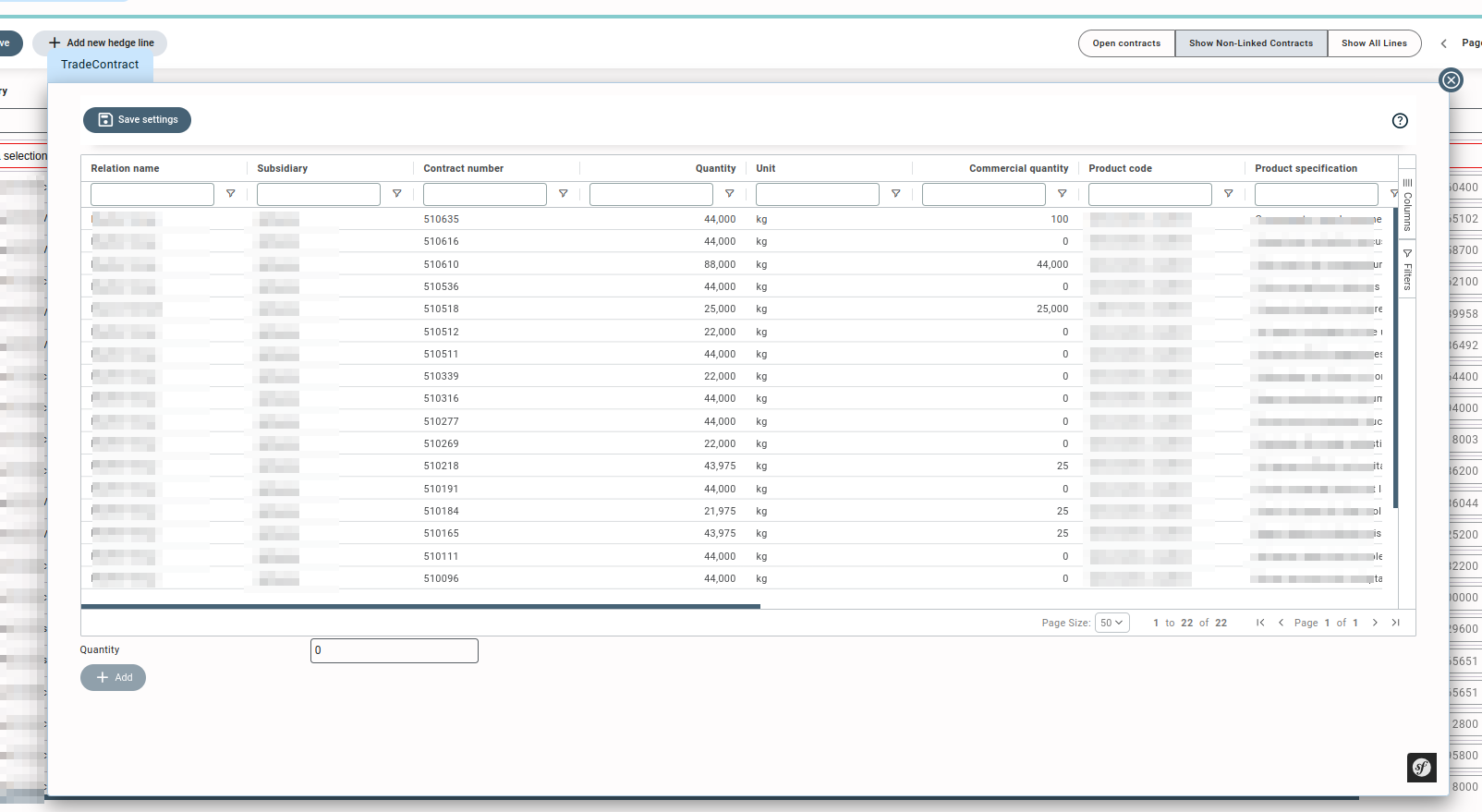

- Click on “Link Sales/Purchase Contract.” A list of contracts will appear in the Contract Selection pop-up based on the subsidiary and currency you selected for the hedge line.

- Select the desired contract and click “Link Contract.”

- The hedge line will now be linked to the contract. You can verify this by checking the contract, which will show the newly linked hedge line.