General description #

Intrastat is a system for collecting and reporting data on goods trade between EU member countries. The system is used to keep track of how goods move around the EU and to put together statistics about trade.

Under the Intrastat system, businesses that do intra-EU trade are required to provide detailed information on their trade activities to their national statistical office(separate for each EU-member state). This includes the value, quantity, and commodity codes of the goods that were traded, as well as the country where the goods came from(origin) and where they were going(destination).

Using Qbil-Trade you can export the invoices for Intrastat purposes. It generates files based on the selected format provided by your country’s national Intrastat authority, which you can download and use for intrastat purposes.

CBS IDEP NL #

CBS IDEP NL is the intrastat data that details the trade activities between the Netherlands and other European Union Member countries. This data is used by businesses in the Netherlands to submit their trading(with other EU members) data to the national statistical authority for data analysis purposes.

Intrastat(CBS IDEP NL) versions in Qbil-Trade: #

Qbil-Trade offers two versions for generating the document for CBS IDEP NL data. You can enable one of these versions based on your business needs to generate the Intrastat data. The format of the document generated is the same for both versions.

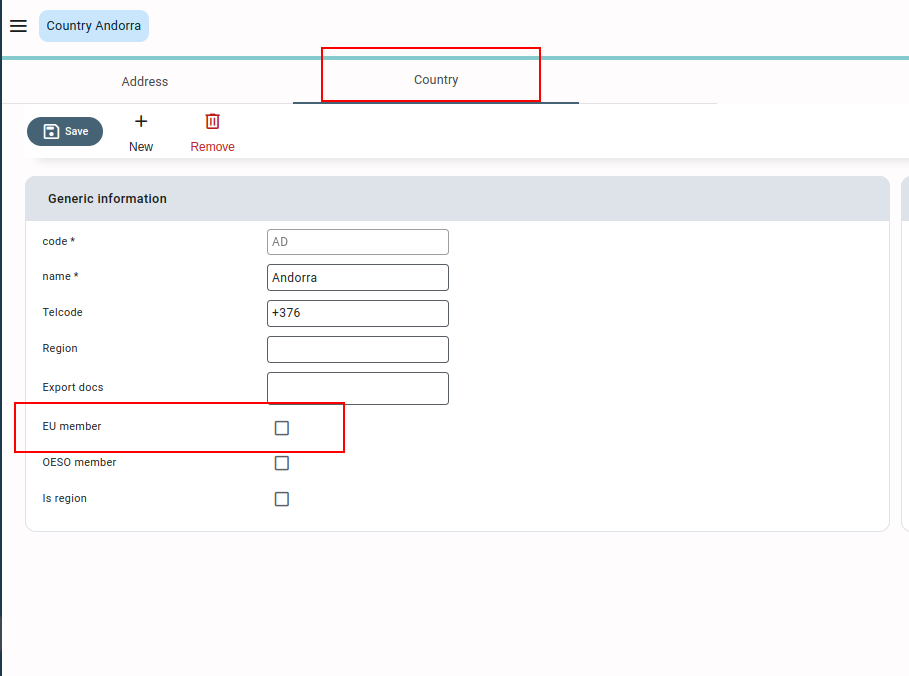

In Qbil-Trade, a country is set as an EU member using the checkbox on the Country screen of rootdata.

Version 1

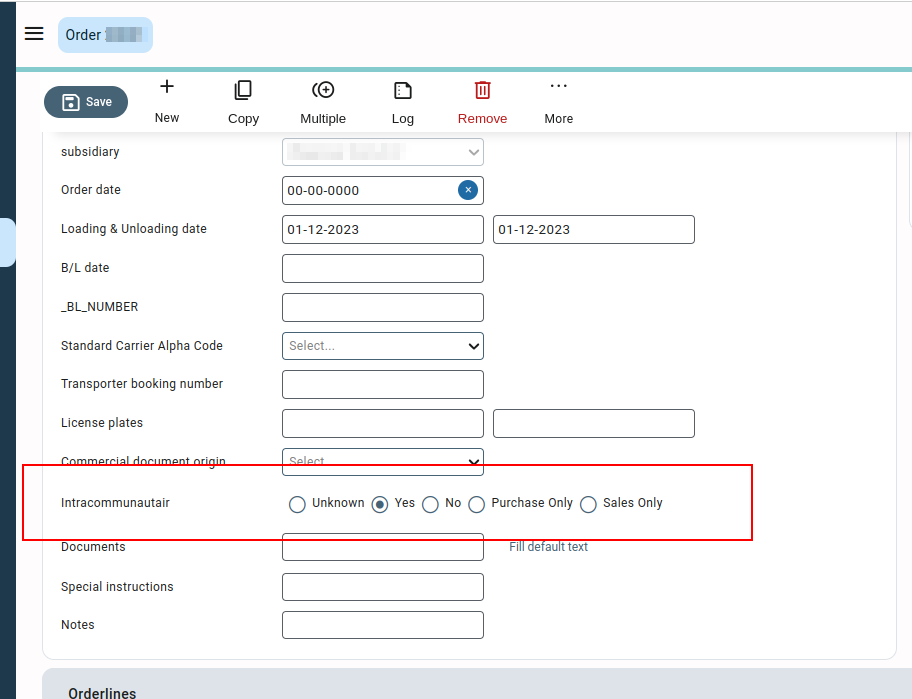

When CBS IDEP NL version 1 is enabled for a customer, the order screen includes an “Intracommunautair” field in the generic section of the order that determines whether or not the invoices are to be Intrastat exported.

- If the intracommunatair status is not known yet, you can specify it as “unknown“.

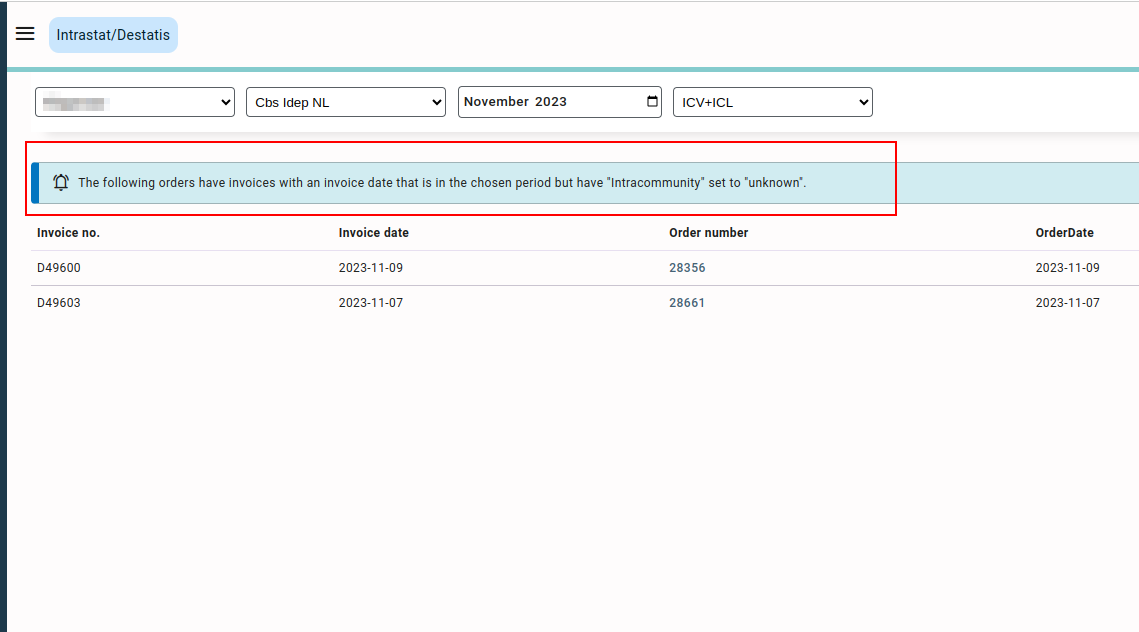

While exporting intrastat invoices, if any of the invoices from the orders with intracommunatair status are set to “unknown“, the intrastat screen will display a message and list those invoices. You can update the order details and download the Intrastat export file.

- If Yes is selected for intracommunatair, all goods invoices (booked purchase invoices) and sales invoices from the order are exported;

- If No is selected, no invoices are exported.

- if Purchase Only is selected, only purchase invoices(booked) are exported.

- And if Sales Only is selected, only sales invoices are exported from the order.

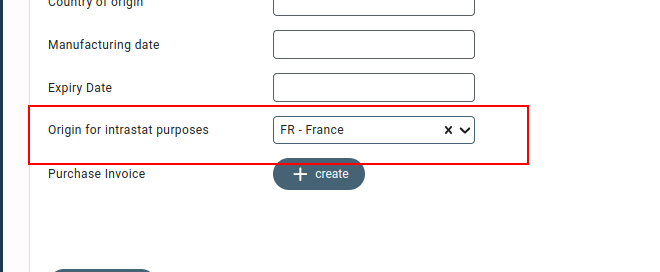

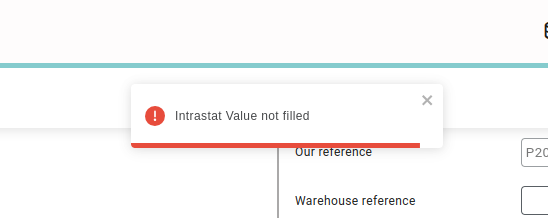

Note: For orders with Intracommunatair set to Yes, Purchase only or Sales only, it is mandatory to enter the value for the field “Origin for intrastat purposes”, otherwise you won’t be able to save an order and a warning is shown for the same.

To ensure that purchase and sales invoices are exported for intrastat, the following conditions must be met:

- Purchase Invoices: For purchase invoices to be intrastat exported, the following conditions are necessary:

- The VAT number of the subsidiary (Our VAT) associated with the invoice should be the Netherlands registered to make sure that the goods are being imported into the Netherlands.

For some customers, the “Our VAT number” selection is disabled on the purchase invoice screen, in such cases the first VAT registration number added for the subsidiary (associated with the invoice) in subsidiary rootdata is considered while checking for the intrastat export. - The VAT registration number (Their VAT number) of the relation used in the invoice should not be the Netherlands registered to ensure the goods are being imported from outside the Netherlands.

If no VAT registered number has been added for the relation and thus none selected in the invoice, but the order has been marked as yes or purchase only for intracommunatair, the invoice won’t be exported. - The VAT registration number(Their VAT number) of the relation should be an EU member ensuring that the trade is done within European states and thus eligible for intrastat export.

- The selected loading address on the origin side of the order line should not be in the Netherlands.

- The VAT number of the subsidiary (Our VAT) associated with the invoice should be the Netherlands registered to make sure that the goods are being imported into the Netherlands.

- Sales Invoices: For Sales invoices to be intrastat exported, the following conditions are necessary:

- The VAT number of the subsidiary (Our VAT) associated with the invoice should be the Netherlands registered to make sure that the goods are being exported from the Netherlands.

- The VAT registration number (Their VAT number) of the relation used in the invoice should not be the Netherlands registered to ensure the goods are being exported outside the Netherlands.

If no VAT registered number has been added for the relation and thus none selected in the invoice, but the order has been marked as yes or Sales only for intracommunatair, the invoice won’t be exported. - The VAT registration number(Their VAT number) of the relation should be an EU member ensuring that the trade is done within European states and thus eligible for intrastat export.

- The selected unloading address on the destination side of the order line should not be in the Netherlands.

Version 2

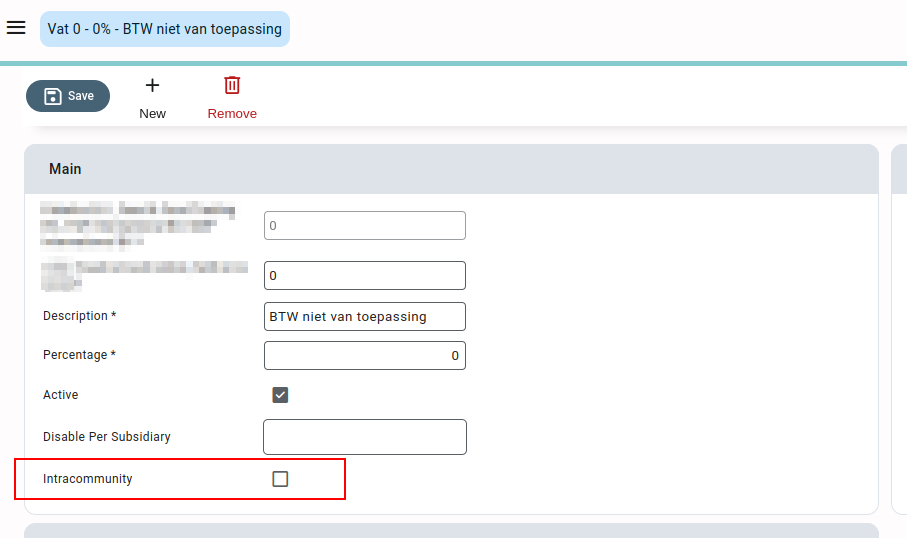

When CBS IDEP NL version 2 is enabled for a customer, a checkbox “Intracommunity” appears on the VAT screen of the root data. The invoices are intrastat exported if the intracommunity checkbox for the VAT used in the invoices is checked.

The conditions for this version for intrastat export of purchase and sales invoices are similar to the conditions explained above in version 1.

Downloading an Intrastat report #

You can download & export the Intrastat report for invoices by following the given steps:

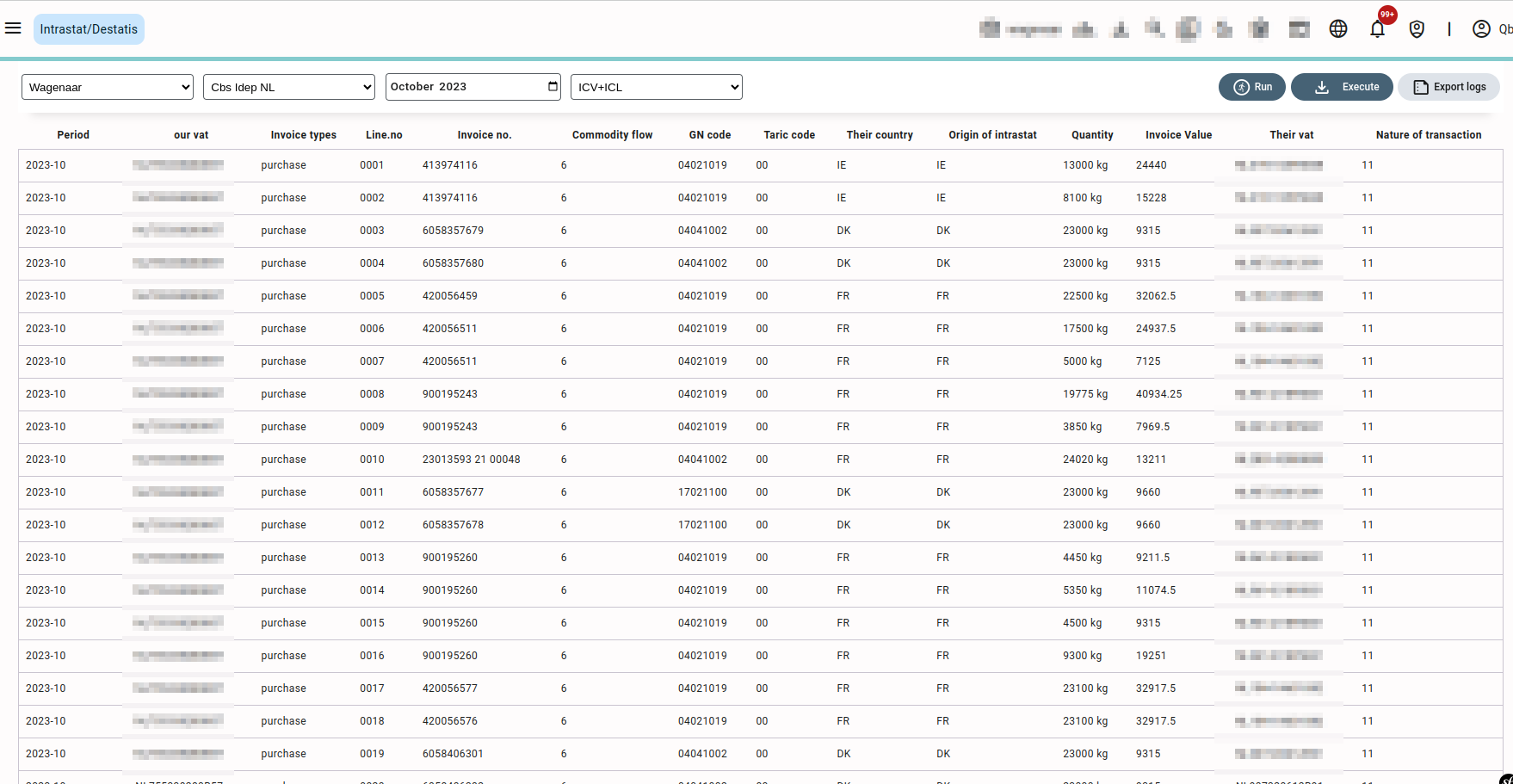

- Choose “Subsidiary” from the drop-down menu.

- Select the Intrastat export type: “Cbs Idep NL”.

- Choose the “period“.

The invoices with invoice dates within the selected period will be included in the Intrastat report. - Select ICV to generate the intrastat overview for purchase invoices only, ICL for sales invoices or ICV+ICL for both.

- Click “Run” to generate the overview of all available invoices available for Intrastat export as per the selection made. This overview lists all the invoices and the other details as per the CBS Idep NL format that will be included in the exported file.

- Click “Execute” to initiate the download of the Intrastat report in format .txt.

The downloaded file can be used to report the intrastat statistics of your trade to the CBS, which is the national statistic office of the Netherlands and is responsible for collecting data regarding the trade between the Netherlands and other European members.

You can also download the previously downloaded intrastat reports using the “Go to export logs”, which will redirect you to the download exports section of “Export”.

Export File Format #

The Exported(downloaded) file gives the details in various columns explained below:

- Period: This column gives the period for which the report is generated. The month and year in the format “YYYYMM” is displayed in this column.

- Our VAT: This is the subsidiary’s VAT number associated with the invoice.

- Invoice type: The Invoice type whether purchase or sales is given in this field.

- Line No: This is the line number or the serial number of the invoice in the intrastat report.

- Invoice number: This column gives the invoice number of the invoice. For purchase invoices, the supplier invoice number is shown in this field and for sale invoices, the sales invoice number is shown.

- Commodity flow: This is the numerical code that represents the type of transaction whether purchase or sales. For example: “6” represents purchase and “5” represents sales of goods.

- GN Code: The column gives the GN code or commodity code of the product. The GN code of the product is usually 8-digit.

- Taric code: The column gives the taric code of the product associated with the transaction. When exporting goods outside the EU, the taric or tariff code is assigned to a product for custom purposes.

- Their country: The column shows the country from which the goods are transported in case of purchase and the country to which they are transported in case of sales.

- Origin of intrastat: The origin of the Intrastat value from the orderline is displayed in this column.

- Quantity: The invoiced quantity is displayed in this column. Negative or zero quantity sales invoices are also exported in intrastat reports as absolute values.

- Invoice value: The column gives the value(amount) of the invoices. The negative or zero-valued sales invoices are also exported as absolute values.

- Their VAT: The vat number(foreign or other than NL) of the relation associated with the invoice is displayed in this column.

- Nature of transaction: This column represents a two-digit number based on quantity, If the value of the quantity is greater than zero, “11” is displayed and if the value is equal to or less than zero “21” is displayed, Thus this column defines whether the order is return order or not.